On Dhan - we are building for two distinct types of personalities, Long Term Investor & Super Traders.

We love this quote by Naval Ravikant.

“All the returns in life, whether in wealth, relationships, or knowledge, come from compound interest.”

In this fast-moving world, it seems that all of us are in a rush to create wealth and retire early. Possibly, this is why the FIRE (financial independence, retire early) movement gained popularity.

Long-term investing isn’t that easy. It’s in fact slow and boring, with much more to do with consistency and discipline. Let’s understand with an example, If Mr. X invests Rs.15,000/- every month that gives Mr. X a return of 15% per year, at the end of 15 years he will be accumulating Rs. 1,00,00,000/-. Amazing, right? Yes!

To build long-term wealth, you also need a long-term investing partner. That is the core belief with which we are building Dhan - every day! We want to ensure that you get the best possible product and investment experience along with awesome customer service.

If you are a long-term investor, there are plenty of reasons you should consider Dhan as your investment platform of choice. Note - we just started a few months back (Nov 2021), so - yes we will be constantly updating this list as we ship more features and improve our existing ones!

Here you go ![]()

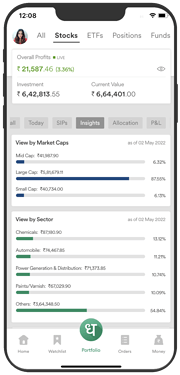

Portfolio with Portfolio Insights

Your portfolio is not simply a place where you see your stocks but learn a lot more about them and how they are performing over the time.

On Dhan, you get the following:

- Overall Portfolio & Day’s Change

- Stocks with SIPs - sorted Daily, Weekly & Monthly (industry first, only on Dhan)

- Portfolio Insights: by Market Cap, Sector, Tax Implications, Highs & Lows of your Portfolio (industry first, only on Dhan)

- Allocation: by Value, Investment, and P&L (industry first, only on Dhan)

- Profit only or Loss only view

- % Returns by CAGR / XIRR (industry first, only on Dhan)

- Tax Implications - Short Term or Long Term

- Ageing of holdings - by 0-3 / 3-6 / 6-9 / 9-12 months and them beyond. (industry first, only on Dhan)

- Easy selling in Single-Tap with EDIS Pre-Authorisation

With this, you have unmatched insights to all your investments - for short term as well as long-term.

Know more about the feature.

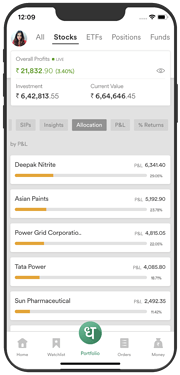

Portfolio Allocation

Portfolio Allocation is the single most important thing that you can do to diversify your portfolio and know its allocation. Dhan simplifies the same, by showing all your allocation (at this moment) by Stocks, ETFs, Positions, and Cash in Trading Account.

And as always, allocation view of this is in real-time on Dhan. (industry first, only on Dhan)

Of course, you will see more products here soon, including Mutual Funds, Bonds, International Stocks, and more.

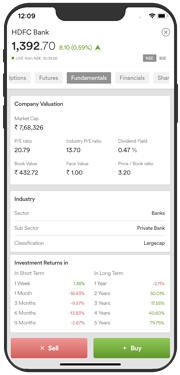

Company Fundamentals & Research:

Long-term investing is made by knowing the fundamentals of the company. At Dhan, you find all the important information in one place. So you never miss any good company to invest in.

- Basic Information like Stock Performance, Market Capitalization, & more

- Ratios like P/E, Industry P/E, and Price/Book ratio

- Financial data like Income Statement, Balance Sheet, Cashflows, Revenue, and Profit trend which is perfectly explained with bar graphs.

- Check the shareholding pattern of the desired company by Promoters, DIIs, FIIs and make smarter decisions

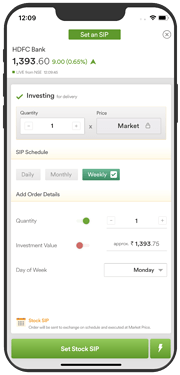

SIPs in Stock:

As an investor, you cannot time the market. But, you can take the advantage of market volatility by SIPs. Markets are volatile in the short term but in the long term, they move upward.

With SIPs in Stocks via Dhan, it will help you to invest in every market condition and compound over the long-term time frame.

- Invest daily, weekly or monthly, and never miss an opportunity to compound your money.

- Set SIPs for Stocks and ETFs to take advantage of short-term volatility for long-term wealth creation.

Know more about the feature.

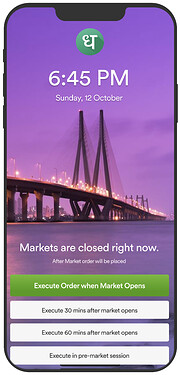

Invest 24 x 7 with inline After Market Order

One of the most loved features on Dhan by its users is that you can place orders anytime- 24 x 7. (industry first, only on Dhan)

Whatever could be the reason - you are working with markets open, you are away, evening is the only time you get to invest, you meet your financial advisor over the weekend and you make up your mind to invest on Sunday - all that, taken care of on Dhan.

You can execute orders when

- Market Opens (9:15 AM)

- 30 mins after market opens (9:45 AM)

- 30 mins after market opens (10:15 AM)

- Pre-Open session of markets (9:00 AM)

Place in-line order anytime 24 x 7, it will get executed when the markets open. (industry first, only on Dhan)

Know more about the feature.

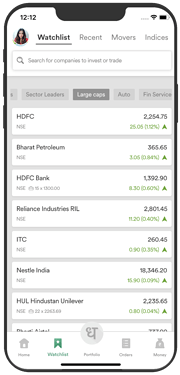

1000 Stocks to track in your Dhan Watchlist:

One can’t get enough of the markets, and ofcourse the number of companies you want to keep a tab on.

Here’s how Dhan helps you:

- 10 Watchlists, each with 100 stocks to track. More than anyone could ask for

(highest in industry)

(highest in industry) - Invested Watchlist: This is bonus - whatever you invest, you can track on Dhan automatically (industry first, only on Dhan)

- Price Performance: from the day you have added, track the price movement of the same. (industry first, only on Dhan)

- If you are an F&O trade by chance, watchlists on Dhan can also help you add shortcuts for Option Chain, Option Summary & Futures summary. (industry first, only on Dhan)

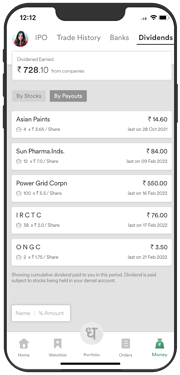

Track your Dividend Earnings:

Investors love dividends. Now track all your dividend payouts in a single view, by company and also aggregate.

- Consolidated dividend payout as it happens

- Track by every company

- Statements on the web as well as on the App

Know more about the feature.

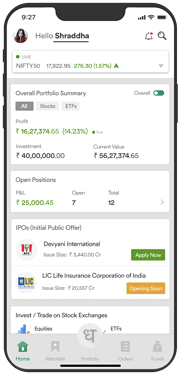

Invest in IPOs:

We have worked smartly to simplify your IPO investing process., once you start investing in IPOs via Dhan - everything else will look… boring & slow.

- Invest in any IPOs with just two simple taps (industry first, best IPO experience on Dhan)

- The fast IPO process does not require you to provide details every time you want to invest in an IPO; the application takes 30 seconds

- Track returns & performance of past IPOs

- See all upcoming IPOs

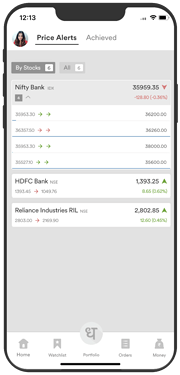

Set Price Alerts:

Markets are volatile, and Investors believe in investing in stocks that have fair value.

Now, you don’t have to keep refreshing your screen. We got you back.

-

Add up to 250 alerts (highest in industry)

-

Set price alerts on stocks based on price or percentage change

-

Get notified instantly when alerts are achieved

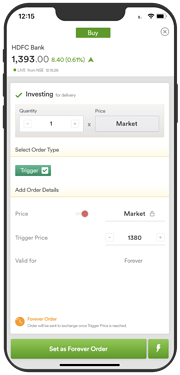

Forever Orders

Every stock that you intend to invest in has a fair value, as well as your conviction to invest, and as an investor, it can be quite difficult to monitor the market every day.

- With Dhan, you can place 250 active forever orders.

Forever Order counters this and makes sure you don’t miss out on any buying opportunities in the market.

Superfast API:

Last, but not least - Superfast Trading APIs from DhanHQ. Build and invest as you want with our APIs. Connect with apps, algo programs, and platforms or build your own - all & more, free of cost to you.

Discover more on www.dhanhq.co

For all of us at Dhan, we aim to provide you with the best possible product experience for investing & along with awesome customer service. No better place than Dhan for long term investing!

Know more about the feature.

We want to Raise the Bar for you. ![]() `

`

Happy Investing!