I am currency traders in my most loved Dhan platform for last few months. I have observed that Dhan is charging GST@18% on brokerages + transaction charges + SEBI turnover fees where other brokers are charging GST on brokerages + transaction charges only. Why such differences? Need your clarification at the earliest possible.

Hi @MonkInTrade ,

We do charge the same GST of 18% on brokerages + transaction charges which are standard for all, you can check the same here

In case you have been charged more other than this do connect us at help@dhan.co

Hi @Divyesh ,

Thanks for your response. I have gone through the link way before I had opened my account in Dhan. Unfortunately that the pricing details as per the link you have provided or or the calculation is mentioned by you are contradicting with the Contract Note provided by Dhan.

For example,

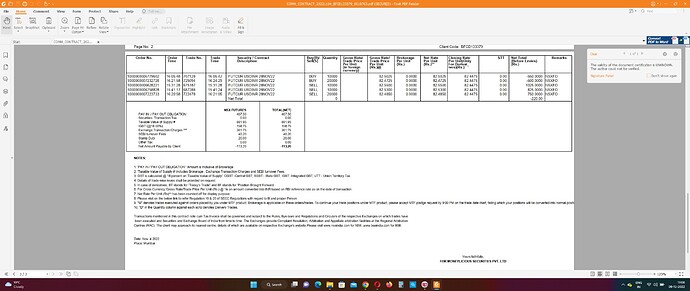

On 4th November, 2022, I had taken 24 trades for which I had been charged Brokerage of Rs. 480 + Exchange Transaction Charges Rs. 361.75 + SEBI Turnover Fees 40.20 = Rs. 881.95 (Taxable Value of Supply). GST@18% of Rs. 158.75 has been charged on this Rs. 811.95 as per the contract Note.

Please note that in the point no. 2 of contract note, it is clearly mentioned that - ‘Taxable Value of Supply #’ includes Brokerage , Exchange Transaction Charges and SEBI turnover Fees.

Please also note that instead of Rs. 480 for brokerage Rs. 467.50 has been mentioned in your contract note which wrong. But in case of calculation of “Taxable Value of Supply” the right amount i.e. Rs. 480. Therefore the contract note itself is full errors and differs from what your organization is claiming or the actual calculation should be.

Unfortunately, we have to pay this extra pennies towards GST every day from our pockets due to this erroneous calculations.

Please look into the matter closely and resolve it at the earliest possible. For your reference I am providing you the screenshot of the contract note I have mentioned. If required, I will provide you the complete contract note for the day I have mentioned above. Expecting your prompt actions to resolve the issue.

Kudos to @MonkInTrade for looking into great details!

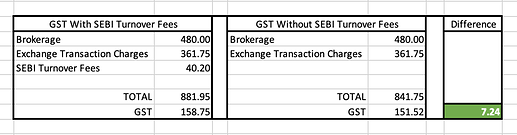

![]()

Difference in GST for the above contract note example,

@PravinJ ,

Looking out for clarification from Dhan.

Thanks @amit for adding required details of the difference of GST, I have mentioned.

@Divyesh & @PravinJ Please look into the matters at the earliest.

hey @MonkInTrade @amit Effective July 18, 2022 - SEBI charges have GST.

Circular is here, hope this clarifies…

Thanks a lot @PravinJ for sharing such an important update. I hope that from next time onwards, I will get an completely error free contract note from Dhan.