When Comparing Same Baskets from Zerodha and Dhan, Dhan asks double the margin amount to execute orders.

@PravinJ

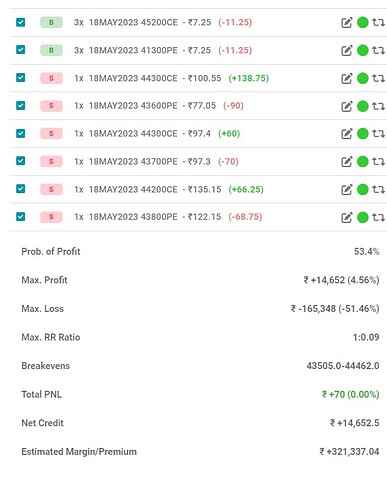

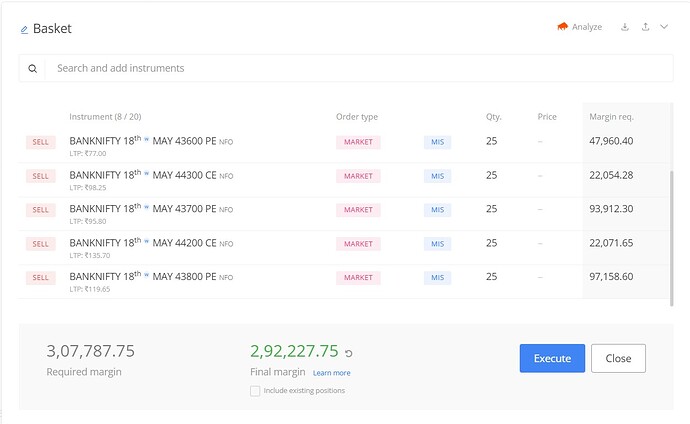

Zerodha margin Requirment - 3.07Lakhs

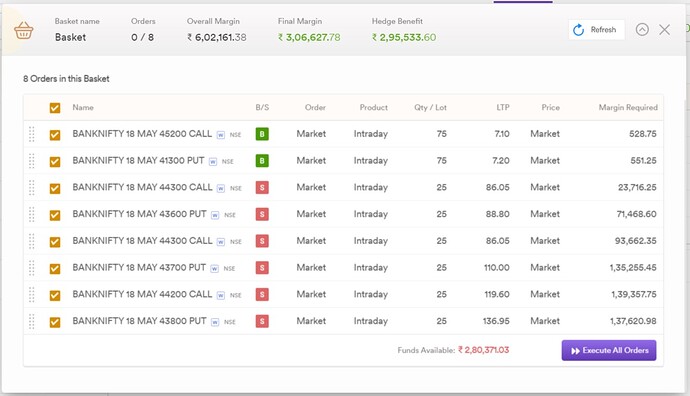

Dhan Margin Requirements - 6.02Lakhs (As double as zerodha)

May I know what is behind this calculation? Zerodha margin is beneficial to me in this case.

Hi @er.thiyagaraju,

As we can see the final margin is similar in both platform and this is the amount which is blocked post execution.

Overall margin is total required for both orders individually and this is required in a rare case both order get executed at the exact same time. Even in that case, post execution, the amount blocked is the Final margin amount.

Good to see you after a while @er.thiyagaraju on community.

To add a bit more from what @Poornima has mentioned, Hedge Benefit is received or Final margin is applicable when when all orders get executed on exchanges. We show overall margin because users need to know that, otherwise we have seen instances where orders get rejected on other broking site despite final margin being available.

Yes, I understand after execution margins are same. But For execution itself Margins are half in Zerodha. I assume after margin rules implementation by sebi, margins across all brokers are same. Who is deviating & which one is correct Yours or Zerodha’s?

Hi @er.thiyagaraju I agree. On Dhan, we want to ensure that your orders go through all the time. It’s a simple logic… hedge benefit is available only after transactions are executed and positions are formed.

That way showing less margin upfront to make users transact doesn’t serve purpose for traders or us. That aside, we had several users who tried executing the baskets / strategies on other platforms and they didn’t go through for lack of funds or margins, as a result only partial orders were executed. We also have seen few platforms showing option premium deducted upfront again to show notionally lower margins.

Regulations are subject to interpretation and/or also how they get implemented in underlying systems. When it comes to margins, we would like to believe that we are doing exactly as requested by exchanges and in-line with what users want - 100% guaranteed execution.

Hi @PravinJ

Atleast consider margin optimisation if one is already having an open position in the underlying which is different from executing a basket.

For instance , say if I have a 18000 PE sell open position from previous day & on next day if I plan to sell 18000 CE also, the margins required should be less as I am converting my trade into a strangle & the first leg was already open.

This is the standard across many brokers

The margin requirement for intraday buy and sell orders is low in the case of icici direct. Example if one has a spread of 20 points 100 units of bank nifty can be traded with an app margin of 2k. Can you look into this ?

Hi @CVRK,

Welcome to Dhan Community!

At the time of order placing, we show the required margin. Further, for any clarification related to margin, do connect us on help@dhan.co