Everything You Need to Know About Trader’s Diary

Hello Traders

We launched Trader’s Diary a few months ago and the appreciation that it’s received from our community of Super Traders has been delightful to see. We’re happy that we were able to build another useful and effective feature for our users, and to see that Trader’s Diary now is an integral part of Trader’s daily routine.

Considering many of our users now use Trader’s Diary, we’ve been receiving requests to create a walkthrough on how the Trader’s Diary really works under the radar. That’s why I’m writing this post today to help you understand how Trader’s Diary works.

Overview of the Trader’s Diary

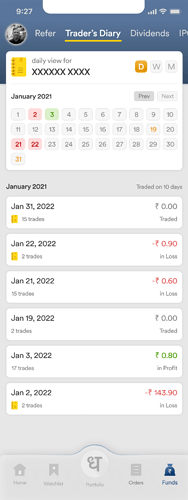

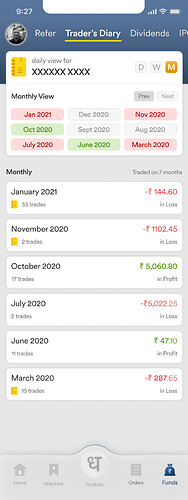

Trader’s Diary allows you to view your Daily P&L and Monthly realised P&L. The two different views of the Trader’s Diary as as below:

Daily view & Monthly view:

,A Day/Month in a Trader’s Diary can be of three colours:

- Red: Loss is realized on that day/month

- Orange: Open positions (only) made on that day/month

- Green: Profit is realized on that day/month

A day may also show zero P&L even though there are a number of trades (Jan 19 and Jan 31 for example in the above screen-shot) because those trades are open.

Explaining Trader’s Diary further in detail:

I’ll be picking a real-life example to show the calculations. But first, let me lay out all the key terms involved in Trader’s Diary:

- Buy Value = Total buy value of all the open and closed positions

- Sell Value = Total sell value of all the open and closed positions

- Realized Profit = Sum of gross profit of closed orders

- Charges = STT + GST + SD + SEBI Turnover Fees of all the open and closed positions

- Brokerage = Brokerage applied on all the open and closed positions

- Net Realized P&L = Realized P&L – Charges – Brokerage

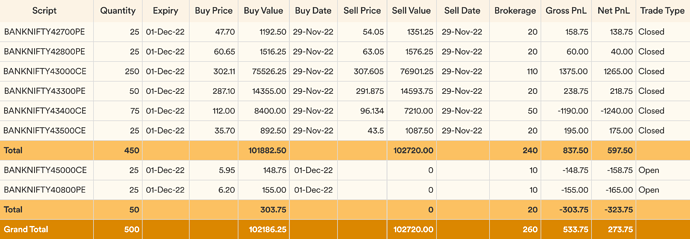

Scenario 1

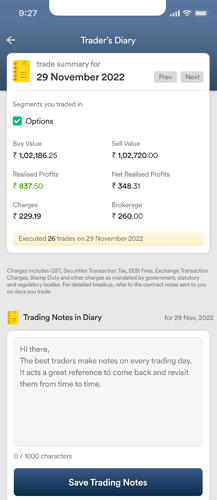

Trader A took 450 intraday positions in BANKNIFTY Options, making a gross profit of ₹837.50. He spent ₹229.19 as charges towards STT + GST + SD + SEBI and ₹260 as brokerage for open and closed trades. Thus, his Net Realized P&L is ₹837.50 – ₹229.19 – ₹260 = ₹348.31

Trader’s Diary:

Scenario 2

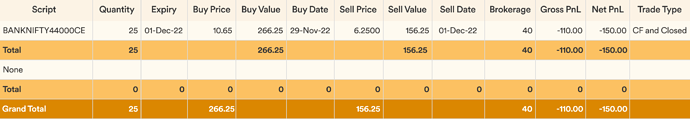

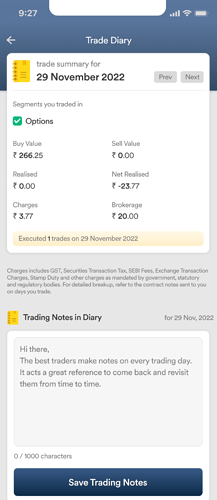

Trader B bought 1 Lot BANKNIFTY44000CE on 29/11/22 @ ₹10.65 and sold it on 01/12/2022 @ ₹6.25. The trade can be summarised below.

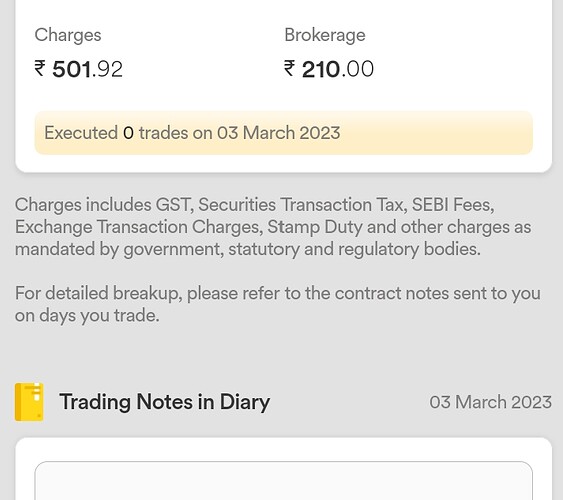

On 29/11/22: He spent ₹3.77 as charges towards STT + GST + SD + SEBI and ₹20 as brokerage. So, his Trader’s Diary will show ₹266.25 as buy value and no sell value (as it was only a buy position). So, his Net Realized P&L is ₹0 – ₹3.77 – ₹20 = – ₹23.77

On 01/12/22: He spent ₹3.70 as charges towards STT + GST + SD + SEBI and ₹20 as brokerage. So, his Trader’s Diary will show ₹156.25 as sell value and no buy value (as it was only a sell position for the day). The P&L of this carried forward trade is calculated internally (₹266.25 – ₹156.25 = – ₹110). So, his Net Realized P&L = – ₹110 – ₹3.70 – ₹20 = – ₹133.70

Trader’s Diary on 29/11/2022 and on 01/12/2022:

,Scenario 3

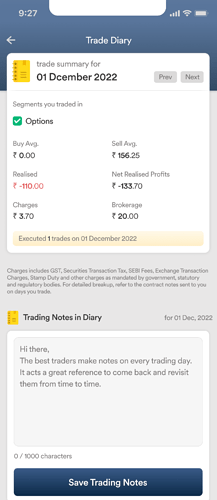

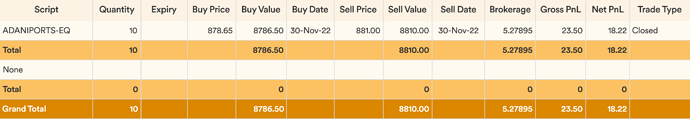

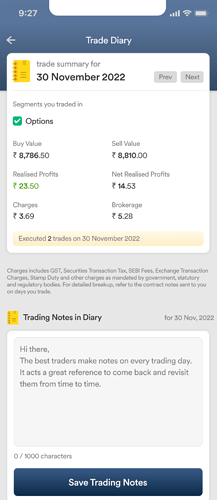

Trader C brought 10 equity shares of ADANIPORTS on 30/11/22 @ ₹878.65 and sold it on the same day @ ₹881. The trade can be summarised below. He spent ₹3.69 as charges towards STT + GST + SD + SEBI and ₹5.28 as brokerage for the trade.

So, his Trader’s Diary will show ₹8786.50 as buy value and ₹8810.00 as sell value. So, his Net Realized P&L is ₹23.50 – ₹3.69 – ₹5.28 = ₹14.53

Trader’s Diary:

Scenario 4

Trader D did multiple trades across EQ, F&O, and MCX segments in the month of November 2022. Below is the attached excel sheet containing the Trade History (Trade Dump) and Traders Diary and corresponding P&L Statement (generated from Dhan).

Here, you can see that if the open positions are NOT taken into account, the Trader’s Diary, Trade History and P&L Statement all three are in sync.

Note that gross P&L is taken into consideration for ease in calculation and understanding.

Frequently Asked Questions

-

Will Trader’s Diary Be In Sync with the P&L Statement?

Yes, but only if dates are chosen such that no open position exists in that duration. You can check scenario 4 on this front. -

How do I check my P&L like any other broker would have shown?

For checking P&L, generate the P&L statement. It will be sent on your registered e-mail ID. -

What time is the Trader’s Diary updated?

The Trader’s Diary is updated at 9 AM everyday. So for your EOD P&L, please check the Trader’s Diary next day at 9 AM. -

Will the Trader’s Diary be in sync with my Ledger?

A Ledger is detailed Cash-Flow of your finances (including pay-ins, pay-outs, charges, MTMs, etc.) which are not part of Trader’s Diary and hence the P&L report as well. -

I have an open position on a script from the past but I do an Intraday trade on the same script. How will P&L be computed in this case?

In an intraday trade case, the previous open position will not be affected and intraday profit or loss will be captured for that day only. -

If I have some positions open and some closed (in profit or loss), which colour code will be assigned to that day?

If any trade is closed (current or previous) on a given day, the colour will correspond to Red/Green depending on the profit or loss made in the trade. Even if the day has an open position, it will not be coded as Orange. -

If I have a future open position, will it be Marked to Market as in the contract note?

Trader’s Diary, as mentioned, is strictly based on realised positions only. Hence, MTM is not taken into account in Trader’s Diary calculations. -

Will my Trader’s Diary match the contract note?

Yes, only if you have no open positions for the day.

I hope you now know how Trader’s Diary works from the inside out. If you have more questions, feel free to write to us at feedback@dhan.co

Regards,

Shrimohan Jhawar