Important Update: On Margins, Usage of Broker Funds, and Interest Charges

If you are a Stock Market trader, you already know by now that over the past few months there have been many changes in how margins are provided & provisioned based on the regulations and circulars released by SEBI and Exchanges from time to time.

These changes affect not just you as a trader but also us as a Stock Broker, while we allow you to trade as much as you can and as fast as you can, it is important that you and us remain compliant with the regulations at all times. Hence it is prudent for clients (you as users) to maintain margins in the same ratio as broker’s do. In case of shortfalls in your margins, the same are fulfilled by brokers (in this case Dhan) and for the usage of the funds, there are interest charges that are charged by brokers (including us) on the debit balance in your ledger as Delayed Payment Charges (DPC). At Dhan, we want to be super transparent and hence don’t want you to be surprised, hence we thought we will walk you through these in relevant details.

Change in Margin Balance Ratio for Users

Traditionally, the Clearing Corporation (CC) has required brokers like us to maintain a 50:50 ratio for margins, which is split as

- 50%: cash and cash equivalents

- 50%: non-cash (approved securities)

You as a trader - can take a trade or have an open position in the market which is either funded fully by cash and cash equivalents or is partly funded (upto 50% by you and rest by the broker).

If you are trading with full cash and cash equivalents provided by you, you do not have to worry about anything here including the interest charges as the 100% margin is provided by you.

But when you take a trade or have an open position - which is part funded by your cash (upto 50% minimum) and rest with broker’s money - then for the usage of these broker’s money - there is an interest amount that is charged - which is commonly referred to as DPC or Delayed Payment Charges. This will be applicable only for the time when your trades use broker’s money and these positions are not exited / settled.

Why is There a Change for DPC?

As an industry practice, when you as a user avail margins/leverage, a broker grants the request based on:

- Cash available in your trading ledger (No DPC in this case)

- Pledge margin value of your securities (With haircut applicable)

- Fixed percentage of unsettled sell amount (80% of sell amount on same day and 100% on next day in lieu of Early Pay-in)

These usage of funds and application of margins is prescribed by the exchanges and regulator across all stock brokers.

Approving the margin requirement comes at a cost to the broker, especially when margins are granted against pledged securities and unsettled sell amount because the Clearing Corporation blocks the broker’s margins until settlement, which is T+2 days (excluding holidays). That’s why there’s an interest applicable on margins utilized in excess of the 50:50 split.

More on Interest on Delayed Payment (DPC)

As a layman’s understanding, DPC is an interest levied on the debit balance in your ledger. However, it is pertinent to note that DPC is also applicable on margins granted to you against securities collateral and margins in lieu of unsettled sell proceeds.

The DPC or interest rates currently stands at 15.99% p.a. You might be wondering when a DPC occurs in your ledger. Broadly, it’s under the following scenarios:

- When you take positions based on margins granted to you but margins are not maintained in the 50:50 ratio as prescribed by exchanges.

- Do not pay for Buy Trade within T+2 days

- When you avail margin funding facility

- When charges debited in the ledger are not paid immediately

Here’s an example 1. Say Mr. Jay Kumar buys shares worth Rs. 1,00,000/- on Monday based on the margin availed by him against shares worth Rs. 1,25,000/- sold on the same day. The exchange’s minimum upfront margin requirement is say Rs. 20,000/- for Buy Trade and Margin is required to be maintained in a 50:50 ratio. In the given case Jay Kumar does not have either Cash or Securities margin therefore, the interest will be applicable on Rs. 20,000/- for 2 days i.e. Monday & Tuesday.

In another example 2. Say, Mr. Jay Kumar buys shares worth Rs. 1,00,000/- on Monday based on the margin availed by him against securities pledge worth Rs. 1,00,000/- (after hair cut value). The exchange’s minimum upfront margin requirement is say Rs. 20,000/- for Buy Trade and Margin is required to be maintained in a 50:50 ratio. In this case, Jay Kumar does not have a Cash margin. But, he has given Securities margin. Thus, the interest will be applicable on the 50% Cash Component of margin of Rs. 10,000/- for 2 days i.e. Monday & Tuesday.

Now, Mr. Jay Kumar was supposed to pay Rs. 1,00,000/- by T+2 days. But, he delays the payment beyond T+2 days and makes the payment on Thursday. Then he will be required to pay DPC @ 0.0438% per day (15.99% p.a.) for 1 day.

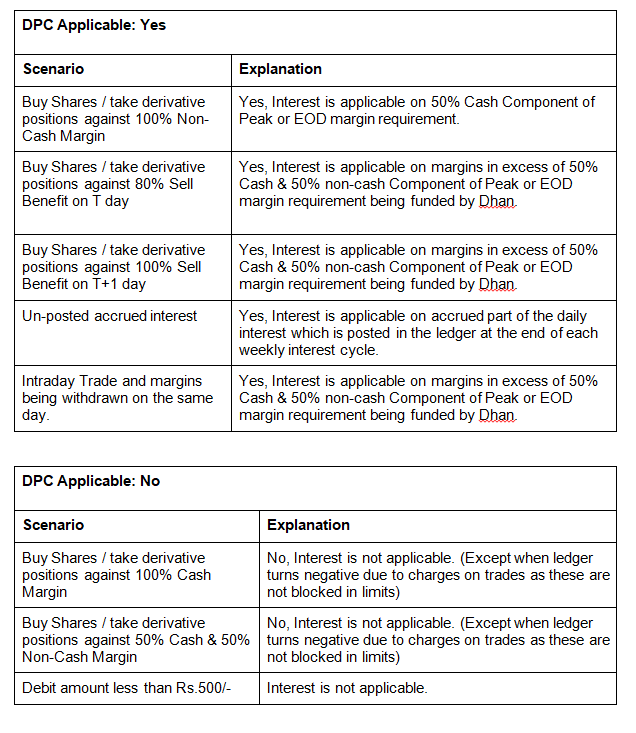

Possible Scenarios for DPC

Hope this is clear to you on how and under which scenarios the Delayed Payment Charges for Margins are applicable.

On Dhan, for trading in intraday stocks we provide margins on 900+ stock for Intraday - this is completely free and no interest rates are applicable on Dhan for intraday in cash segment. And while trading, users on Dhan have the option to get margin benefit on Pledge Shares - where you can get additional margin instantly in a few minutes on over 1450+ stocks.

The pledge benefit that Dhan provides to you can be availed for Options Buying as well as Selling, on all types of Trades (Buy or Sell) and on all segments (Equity, F&O, Currency & Commodities) and across all Exchanges (BSE, NSE & MCX).

Thank you

Rajesh Jain