Traders need a lot of capabilities in trading platforms to ensure they minimize their risks and also at the same time focus on being profitable. Some of these are especially important in the volatile markets that we are witnessing these days, or even otherwise.

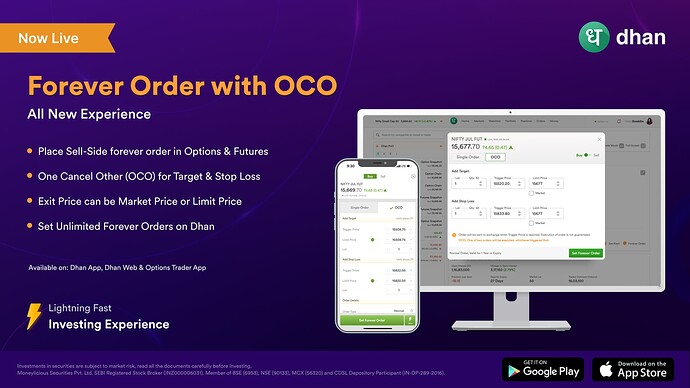

Over the period of last few months, we have kept making Dhan better with trading focussed features like - Integration with TradingView (tv.dhan.co), Basket Orders with Margin Benefit, Managing Open Positions as Group based on underlying, Reverse Order, and many such. But yes - there was one that many users have asked us to introduce over this time, Forever Orders on Sell-Side.

Today, we are announcing this - an updated version of Forever Orders on Dhan, and we are super excited about this.

With Forever Orders on Dhan, now you can

- Place a Sell-Side Order as Forever in the Options & Futures segment

- Forever Order can exit at your defined Trigger Price at a Limit, or also as a Market Order (Yes!)

- Introducing OCO along with Forever, so you can set your Target & Stop Loss at the same time

- Unlimited Forever Orders, yes - you can place as many as you want.

This feature is now available on the Dhan app and will be extended to Web (web.dhan.co) in the next week. We will also introduce this on the Options Trading app in the next release.

Most traders would already know of this, however, we will re-emphasize here that Forever Orders are maintained in our systems for 1 Year, and very importantly - execution of Forever Orders is not guaranteed as it depends on multiple factors including liquidity at the time these orders are triggered to exchange and also margin available in your Dhan trading account at the time of execution. Which is the reason for us to introduce Market Price on Forever Orders for the sell-side.

At present we have enabled Forever Orders in the F&O (Futures & Options) segment for Equity & Indices on NSE.

What is the OCO order?

An OCO (one-cancels-other) order is a pair of conditional orders stipulating that if one order executes, then the other order is automatically cancelled.

An OCO order often combines a Stop-Loss order and a limit order (Target) with a trigger price. When either the Stop Loss or Target Price is reached, the order is sent for execution to exchanges at the set Trigger Price. The other order is automatically cancelled in this case.

SuperTraders use OCO orders to mitigate risk.

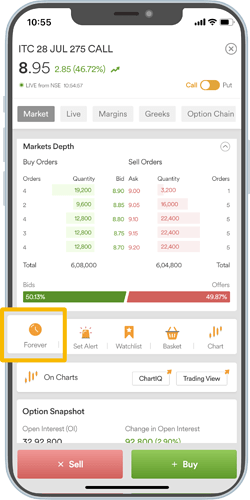

How to create a Forever Order on Dhan?

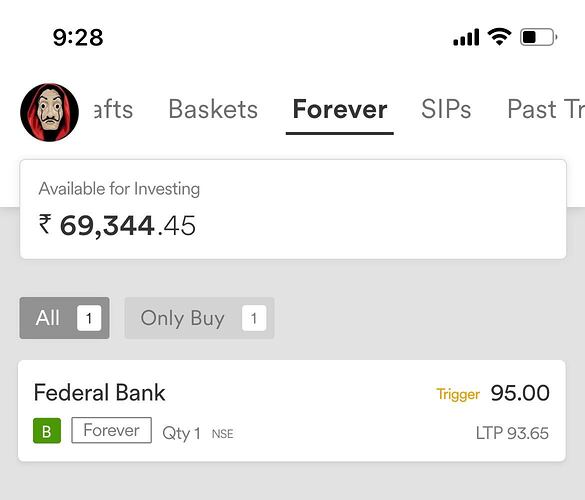

It is simple and seamless as always on Dhan. For every scrip (Option or Futures) on which there is the possibility of creating a Forever Order available - you will see the same, as highlighted in the screenshot below.

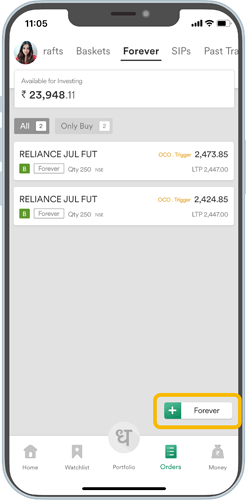

In addition to this, you can create a new Forever Order under the Forever tab of the Order section in the App or on the Web. Depending on the scrip you select, you will be able to see appropriate options to do a Forever Order. It’s all built seamlessly just like a Super Trader will want to experience it.

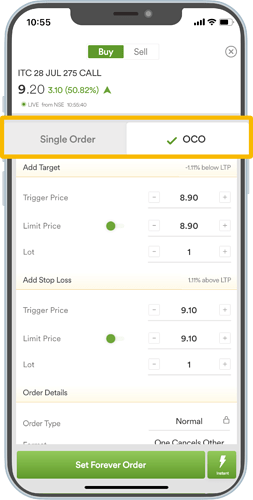

How to create a Forever Order with OCO?

When you select any of the Futures or Options in the equity segment and tap on Forever Order, you will see two options for you - a Single order or an OCO order.

Margins Required for Forever Orders

You don’t need any cash or margins in your account to create a Forever order. The system only checks for margins when the Forever is triggered and an order needs to be placed on the exchange. You will need to have margin available only then.

Super Traders on Dhan will already know that we show you the Margin Required for your Forever Orders all the time in the same section, and in addition, you also have the Funds Shortage feature to keep you updated on the margin & funds required.

Validity of the Forever Orders

Forever Orders are valid for one year. If it isn’t triggered within one year, the forever order will be cancelled.

Forever trigger is valid only once. So, if an order gets executed and gets rejected from the exchange side due to any reason, you will need to replace the Forever Order again.

Note: Sell-side Forever Order (Single or with OCO) is only for Derivatives contracts, as equity selling needs EDIS authentication.

Dhan is super focused on building the best investor & trader experience for you. Hope these product & feature improvements help you stay on top of the markets and make informed decisions. All these features will be available on the Dhan App, Web (web.dhan.co) and the Options Trader app.

Do let us know your feedback. We listen to you ![]()

Product Team

Kiran