Hello Super Traders,

As a product & technology focussed platform, all of us at Dhan are on a journey to bring an incredible trading & investing experience to you. With that, we start this month of August with a key feature for both - investors and traders on Dhan.

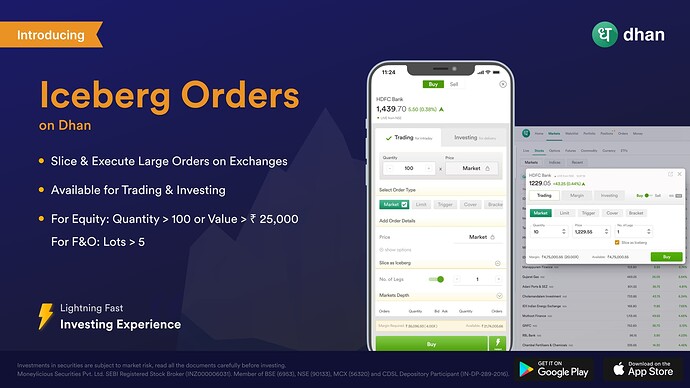

Last week we introduced Trailing Stop-loss: Traders’ best friend and now we are here with another amazing feature - Iceberg Order, starting with the Dhan App and soon will be available on Options Trader App, and on Dhan Web.

We know you are waiting for it, cause we told some of our users about this on our community and social media channels. So you do get sneak previews about what Dhan is building when you follow us on our communities on Dhan, Twitter and Telegram. ![]()

Before we go to use the case of Iceberg Order let’s understand what it is.

What is an Iceberg Order?

An Iceberg Order is a large order which is divided into smaller parts so it gets executed one after the other in parts instead of a single large order. Just like an Iceberg, only a small quantity is disclosed that is visible on the Stock Exchanges in the market depth.

The term “iceberg” comes from the fact that the visible lots are just the “tip of the iceberg”

Just like how one can see only the tip of the Iceberg and not it completely, same goes for the Iceberg order.

How do Iceberg Orders work?

When a large order is placed, it is divided into smaller orders, and the first order of the divided (or sliced) orders will be placed first on the exchange. Once the Order is executed the remaining orders are placed one by one until the entire order is executed.

Let’s understand with an example:

Assume I want to buy 30,000 quantities of Tata Motors, and I don’t want others to know about it. For this, I can slice my order into 6 legs. That is 5000 qty at a single time. Whereas the exchange will show only 5000 qty to others. This way, every subsequent order from 30,000 will be executed only once the previous batch of 5000 quantity is executed.

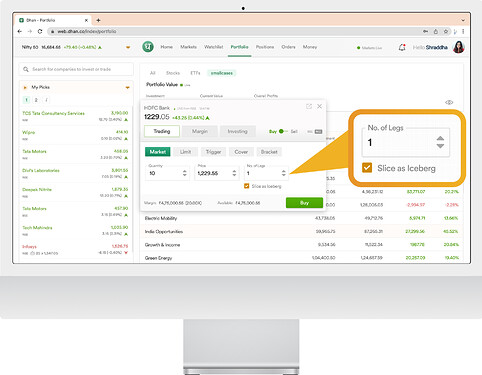

How to use Iceberg on Dhan

- Select Buy / Sell

- Enter Quantity and the Price

- Select Market or Limit

- Enter the Number of Legs and click on Buy or Sell. The maximum number of legs per Iceberg is 10

Note:

For Equity: Quantity must be 100 or the order value must exceed 25,000 in value.

For FnO: Minimum 5 Lots

Please note that brokerage for Iceberg Order (means all sliced orders) will be as per Dhan’s Pricing, mentioned here on Pricing & Detailed Brokerage Charges | Dhan and also mentioned in the post, every Iceberg order is sliced in multiple orders / transactions as specified by you.

This awesome feature is now available on all the platforms: Dhan App, and will be on Options Trader App & Web.

We keep bringing such amazing features for you. Do let us know your feedback.

Naman

-Product @ Dhan

great going dhan.

great going dhan.