We understand that as traders, the most important thing for you when you trade is to make money - and more important thing to do is minimise your capital while you trade. Less money you bring, the less is your risk - it’s that simple.

We worked with Traders and understand their needs, with that over time we have transparently brought on multiple products & features for you with respect to Trading & Margin -

Dhan allows you to get additional margin benefit against pledge on over 1450+ stocks (Introducing: Pledge Shares for Margin Benefit) - and you know already that this margin benefit can be used across all segments, on all exchanges, on all order types and also on Options Buying as well as Option Selling. Pledge on Dhan is instant and selling & un pledged is in-line which means you do not have to first un pledge and then sell. And only on Dhan we show you the real-time value of Pledge Benefit.

For Intraday traders, Dhan also provides you up to 5X intraday leverage on 850+ stocks; more features like industry first Transaction Estimator (Now Live on Dhan - Transaction Estimator), Basket Orders with Hedge Benefit, and introducing the margins for quick reference on all the scrips on Dhan.

We understand that for traders, beyond the ones mentioned above there could be multiple opportunities to trade, specially for Swing Traders, Short Term Investors or BTST Traders. There are times when your funds are blocked in existing positions and you spot an opportunity in the markets or you simply want to use leverage to increase the potential returns from a trade. In such scenarios, margins are the go to product and now we take a step further to make trading even more fruitful with Margin Trading Facility (MTF) on Dhan.

Introducing: Margin Trading Facility (MTF) on Dhan. Now available on Dhan Web & App

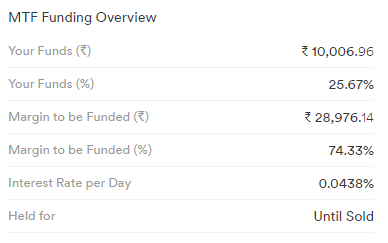

MTF stands for Margin Trading Facility (commonly referred to as Margin Funding) wherein when you have to trade / invest, you bring in part of the funds of the trade (known as your margin) and the stock broker (in this case Dhan) brings in the remaining funds on behalf of you - so that you can by the desired shares with lower margins / capital required from your end. Note: The exchange always requires the full capital, so Dhan arranges for the same in this case for a smaller interest amount.

Now, once purchased you can hold these stocks for as long as you want till the margins are provided by Dhan. MTF as a investing / trading product is particularly built keeping in mind the interest of :

- Equity Swing traders

- Short Term traders

- Traders looking at doing BTST trades.

Incredible MTF experience on Dhan

Here are some cool offerings that we bring to Dhan for a better Margin Funding experience with MTF for you:

- We give up to 4X leverages while buying 950+ stocks using MTF ( List of stocks eligible for Margin Funding)

- Hold Stocks for Unlimited Period: No restrictions on time period, stocks bought using MTF can be held as long as you want and maintain required margins.

- Margin Funding Estimator: To make things as transparent as possible, we introduce a Margin Funding estimator that shows you the margins that will be required to place along with all estimates before you take your MTF trade.

- Simple Order Flow: MTF is integrated and easy. Simply select MTF while placing orders, Dhan will automatically show you when MTF is applicable and the margins provided.

- Shares bought via MTF will be tagged separately in the Positions & Portfolio section.

- These MTF holdings can be sold seamlessly from MTF tab without any un-pledging required.

- Enjoy interest free funding on stocks till they are settled.

- Interest Rate of 0.0438% per day on the funded amount.

- Pledging of MTF shares is seamless and quick. Pledge anywhere between 4-9 pm and enjoy the benefits of Margin Funding.

How do I place an MTF order?

Placing an order using Margin Trading Facility is as simple as placing any other order on Dhan. There are no additional steps or processes required for its activation.

- Select a stock on which Dhan provides MTF, say for example SBI.

- Tap on Buy and go to the order screen and select MTF (This section will be activated for stocks eligible for MTF)

- Add the required quantity and order type. You can also view the margin required to buy that stock using Funding Estimator and accordingly place the order.

- Tap on “Buy with MTF” and your order is placed! Pledge these holdings between 4-9 pm from the Positions page for it to qualify as an MTF order.

Refer to the video for a better understanding ![]()

While this is only the first version of our MTF release, expect many more exciting updates to the product as we go along. For any other questions that you may have please refer to our detailed FAQs. We will also be releasing a detailed note on the important things to keep in mind while using MTF so lookout for that.

As always, we hope to provide you a wholesome trading & investing experience & look forward to your feedback.

Please note: We provide upto 5X leverages on 850+ stocks for intraday and upto 4X leverages on 950+ stocks for MTF.

Thanks,

Pranita

Product @ Dhan