These days markets are volatile and we are seeing few stock positions change from extreme sides - open on positive and close on negative or it is the opposite. But that’s what markets are like, and in between that you have opportunities to trade fast and make your profit.

When markets are volatile, you want to profit off of the fast moving sentiment from bearish to bullish and vice versa. So here we are with our latest feature to help you trade smarter and faster. When market sentiments change, you can also change your positions now with our latest offering - in a single tap. No need to place two orders, now in a single order. Yes, you read that right.

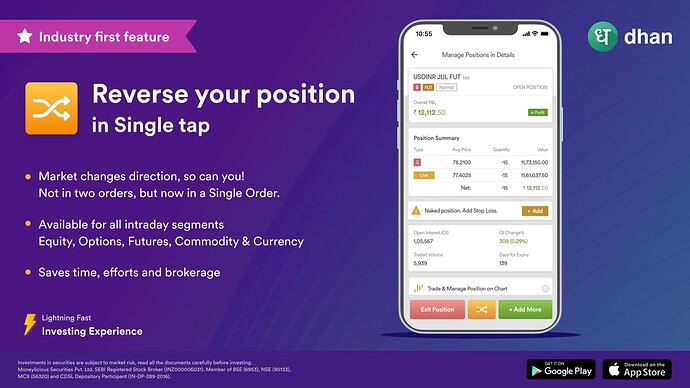

Introducing new & industry first feature - Reverse Your Position in single tap

How does it work?

Assume that you bought 1 stock of Tata Motors. And for some reason, the market changes its direction from bullish to bearish. In such market conditions, to profit off the bearish trend you want to short Tata Motors. So now, instead of placing two orders - square-offing the first position and creating a new short position, you can simply reverse the position. So you don’t have to make two trades and pay the brokerage twice.

This feature will help you to execute orders quickly with changing market conditions with a single click and one-time brokerage. We are the first in the industry to have this feature and we believe it would make your trading experience effortless.

Here’s the video for your reference:

Available on Dhan Android & iOS app.

Happy trading!

-Naman

Product