Hello Super Traders,

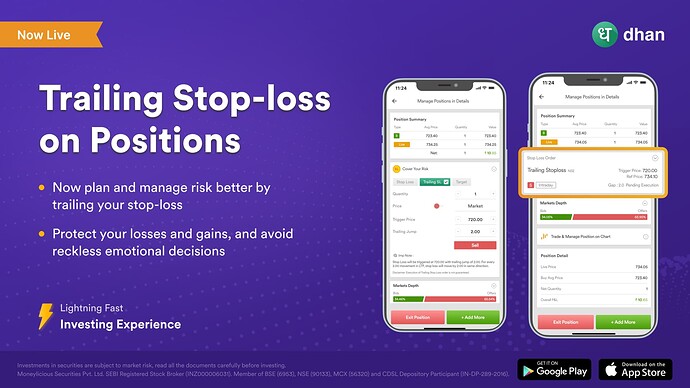

We are super happy when we are writing this, it’s one feature we had tons of requests from our users to bring and here it is now: Trailing Stop-Loss. As many would agree, this is every Super Trader’s best friend.

While building Dhan, we spoke to many traders and realised that the most important thing in trading is Managing your Position. From these discussions, we delivered one of the most popular features of Dhan - Manage Positions on web & App. Now, to make this trading journey even better, we are here with a new feature - Trailing Stop Loss.

We have always delivered and prioritised what is required for super traders to manage risk and make trading a better experience. We know, at the end of the day our super traders need two things - manage risk & make profits or minimise losses.

When we started building trading products, all of us were very clear about the fact that we want to provide everything and anything traders need to manage their position. As positions are the ones that make traders stand on their toes and give an adrenaline rush. They should have every tool in hand while tracking and managing positions, from the time they taken one till the time they exit.

With all this in mind, earlier we released the Manage Position feature for both This feature was completely made with inputs from the Dhan community. We have provided all the tools to manage your trade better.

- Position details & summary

- Convert to intraday/delivery

- Exit Position or Add More

- Reverse Order

- Stop-Loss Nudge on naked position

- Market depth

- Transaction details

To improve the position management experience we are now coming up with Trailing Stop-Loss.

What is Trailing Stop-Loss?

A trailing stop is simply a Stop-Loss Order which combines both risk management as well as trade management. Hence the stop loss trail with the last traded price in one direction. This is significant when traders want to protect their gains in a position. This order type allows traders to avoid knee-jerk decisions based on emotions and helps them to execute pre-determined trading plans.

How to Place Trailing Stop-Loss?

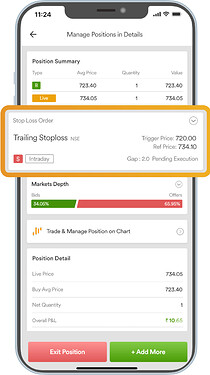

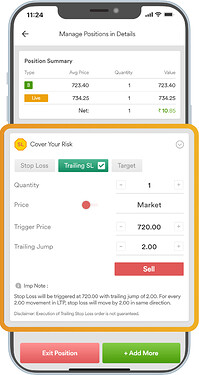

You can place trailing stop loss at Dhan from Manage Position. To access Manage Positions click/tap on that position. If you have a naked position, you will see a nudge “Cover Your Risk”. When you click on the nudge, you will get three options to manage risk:

- Stop-Loss : Simple SL-Market & SL-Limit

- Trailing SL : The one we are talking about

- Target: A simple limit order

When you click on Trailing SL, you need to input quantity, toggle for SL-L & SL-M, trigger price and trailing jump. We are sure that all input fields are explanatory but trailing jump. Trailing Jump is the price difference by which Stop-Loss (Trigger Price) will move when LTP moves by equal points.

Advantages of Trailing Stop-Loss

- This order type will automatically sell your stock when share levels drop.

- This order doesn’t limit your profits. The stock price can still rise and you’ll stay invested as long as prices don’t fall below your stop loss.

- You’ll be able to enter any trailing stop-loss percent for a customised risk management plan. As it’s versatile you can edit it.

Example of Trailing Stop-Loss

Let us assume you have a long position in Tata Motors and the buying price is 410.00.

You place a trailing stop loss with a trigger price of 400.00 and a trailing jump of 2.00.

Now, if the LTP moves from 420.00 to 422.00, Stop-Loss (Trigger Price) will also move from 400.00 to 402.00. If LTP moves from 422.00 to 423.0, Stop Loss will not move, as the trailing Jump is 2.00 and the market price has moved 1.00. Now, if LTP drops, like from 423.00 to 421.00, Stop-Loss will not move, as it trails only in one direction i.e. direction of profit. And next, Stop-Loss will only move when the market price crosses 423.00 (here, only when LTP reaches 425.00), as 423.00 is now the reference point.

Trailing SL as a feature in the industry, is usually offered as a package with Bracket Order. We have consciously made the decision to bring it separate from Bracket Order and provide it on top of positions. As it will avoid dual leg execution during high volatility.

Hope you like this! Happy to get your feedback on this.

Happy Trading!

-Naman

Product @ Dhan