Hi All

Dhan’s TradingView trading platform (on tv.dhan.co) has almost all the important indicators and drawing tools a trader would ask for. We have built a few over-the-top features on tv.dhan.co together with the members of this community to improve their trading experience. Over the past few months, we have shipped many such capabilities for traders - right from executing Basket Orders, Synchronisation of Charts Settings, New Indicators, Live Data & analytics tools, Futures Chains, Options Chains, Greeks, and much more…

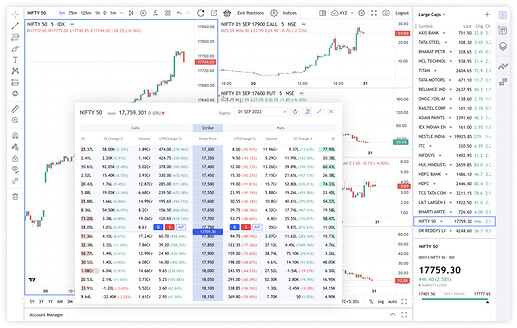

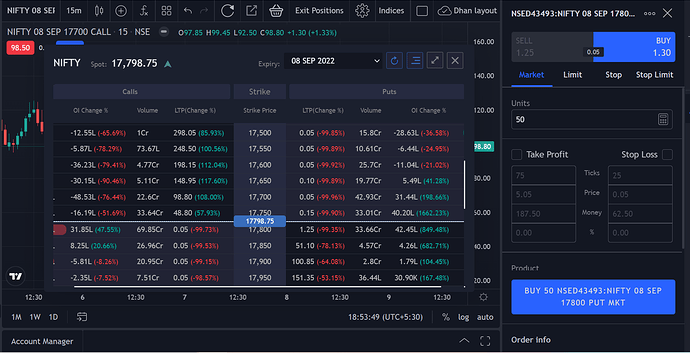

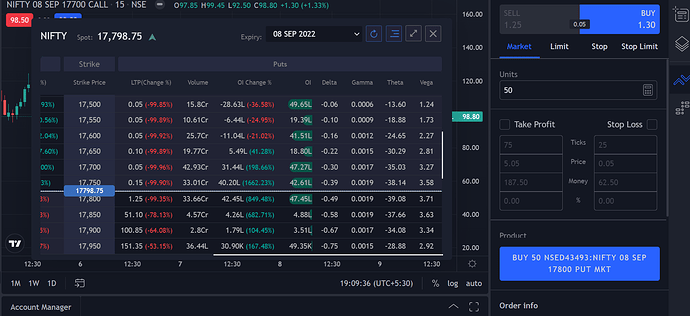

Options are the most traded instruments in Indian capital markets. One of the unique things that Dhan provides for Indian traders - is the ability to trade on Options, with Options Charts and access to Options Chain, right on top together.

Options’ charts and Options Chain together provides almost all of the data and info a trader needs during the market hours, right from price action, open interest movement, greeks of the contracts, and volume profiles. On top of it, if you apply technical indicators like VWAP or RSI you get the idea of momentum and oscillation as well.

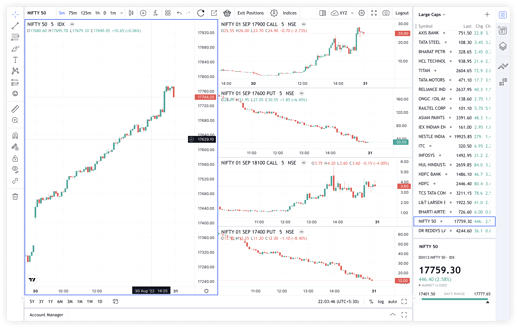

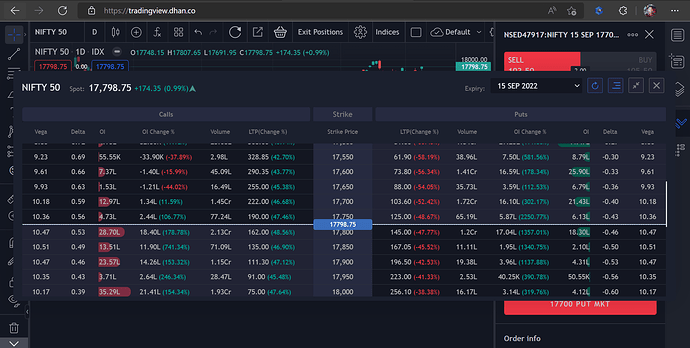

Dhan’s TradingView console (on tv.dhan.co) gives you features and facilities where you can open charts of all legs of your option strategy along with charts of the underlying and options chain together on the same screen. Here is the example for Nifty Iron Condor - a four-leg strategy.

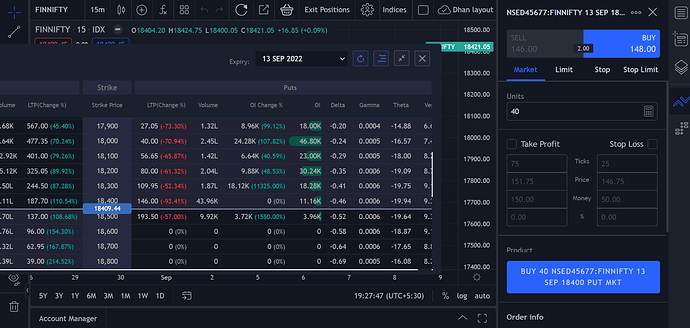

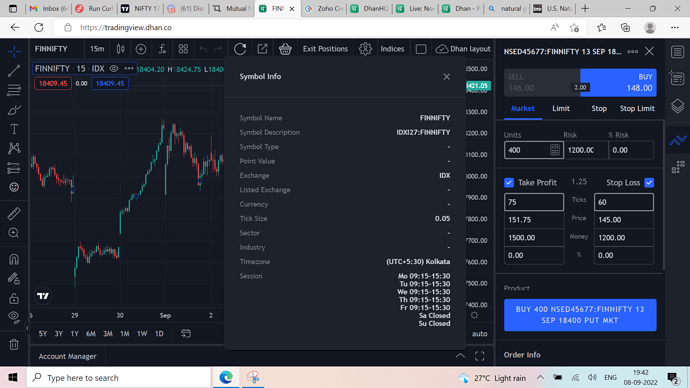

We already have an Options Chain on our trading platform, along with all the necessary data points including greeks.

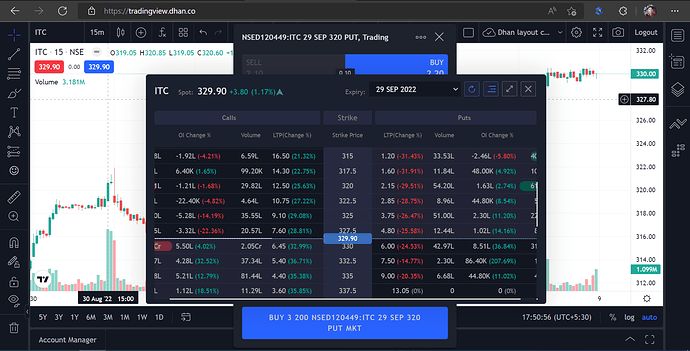

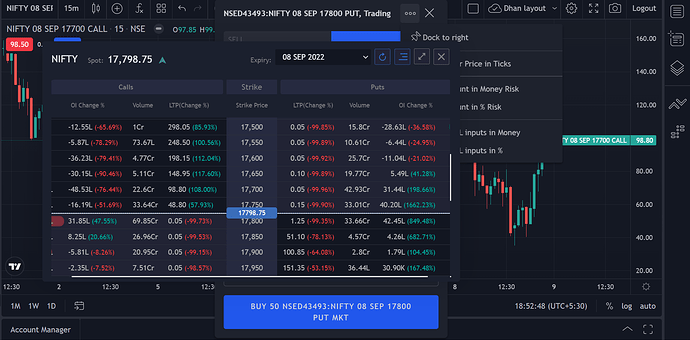

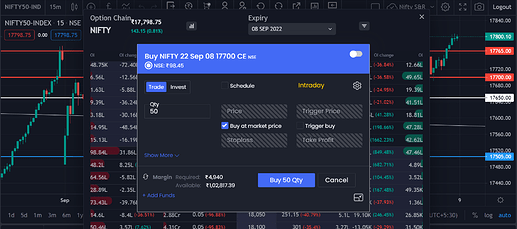

Now we have included a simple, but compelling addition that many of our users had requested - you now have the choice of the Buy & Sell button on Option Chain itself for each option contract that is shown. Also, we have added the button to open charts directly from the chain. Small but significant addition for traders in Options.

I hope you like this update, let us know in the thread what all more additional tools you need for Options Trading on our trading platform on tv.dhan.co.

Happy Trading!