@Poornima any update on the same .

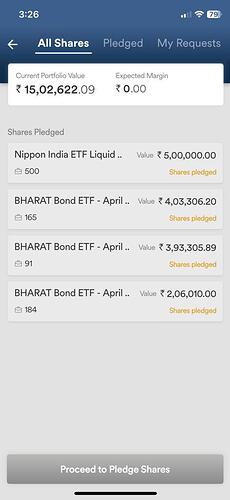

15L pledged in Bharat Bond , after haircut should be around. 13.5 L + as per the dhans shet mentioned .

But only 13L is being shown . Kindly check and revert

Dhan: Collateral Cash Equivalent for Margin Utilisation. Where the latest sheet for this can be found?

At any given point of time, where can the latest Collateral Cash Equivalent for Margin Utilisation list of scrips be found?

Hi @Swadesh

At this moment, you can view the pledged shares detail in the Combined Margin Statement . Further, request you to help us with more details of your requirement so we can assist you accordingly.

Also, the above list of shares is the latest link as per our RMS policy.

Hi @kuldeep @Sameet @Divyesh @Poornima @PravinJ

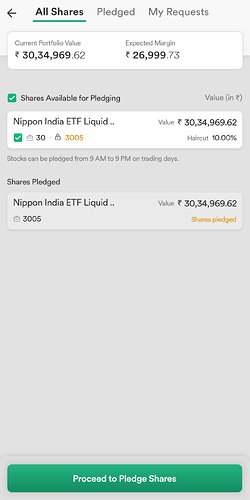

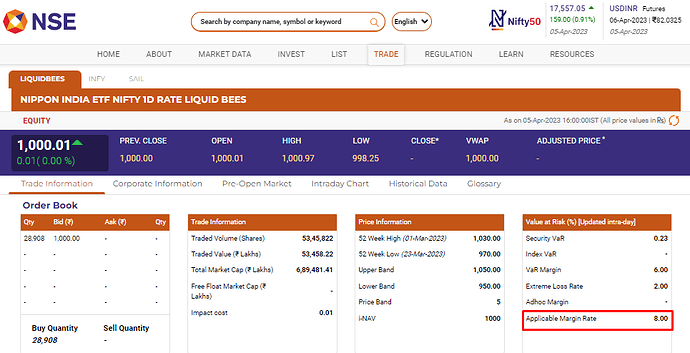

Zerodha applies 8% haircut for liquidbees. They say they are following the VAR stipulated by the exchange.

Dhan applies 10% haricut for liquidbees. Dhan seems to be following the clearing corporation 10% hair cut specification. Is there a possibility to reduce the hair cut to 8% following the zerodha VAR method.

Hi @t7support Dhan offers margin benefit across segments (Cash, F&O, Currency and Commodities) and also across exchanges (BSE, NSE and MCX) and including Options Buying as well. Don’t think that some of the large discount brokers offer that - there is an element of risk involved.

Having said that, for cash and cash equivalents, I don’t see a reason why we should not match the exchange margin rate. I will still speak with our risk team and review this, its their call at the end of the day.

Adding more: All pledge and unpledge on Dhan is instant, one can sell pledged securities instantly without requiring to unpledge before.

Yes brokers like zerodha doesn’t allow option buying with pledged margin. I am aware of that. Also they have restrictions on buying OTM options which means user doesn’t get the hedge margin benefit at the time of placing a hedged sell strategy.

Ya it would be nice if we get 2% less haircut

Yes aware of that and certainly a great feature to have.

There are many reasons which prompted me to switch from Zerodha to Dhan. You guys are doing a great job. I hope to stick with Dhan for a very long time into the future.

Welcome, will post a note on this shortly @t7support. We will extend this to some popular ETFs.

Dear @t7support ,

Yes , it has increased. This is because clearing house var is 10% & since we have to do a real time allocation, we are unable provide 8% haircut benefit.

Thanks,

Pranita

Product @ Dhan

@Pranita as pointed out earlier NSE VAR is only 8%. So it was earlier reduced to 8%. Now why did Dhan switch back to clearing corporation VAR ?

Hey@t7support,

We are now required to do real time allocation. Shares that you pledge are immediately re pledged with exchange and we receive margins after 10% haircut only. Providing any haircuts will lead to a real time shortfall.

Thanks,

Pranita

Product @ Dhan