Hello Options Traders,

We understand how difficult it is to get Options Data like charts or Options Chain at one platform, create strategy on another, do its OI & IV analysis at some other place, and then execute trade on the broker terminal. In fact, not only do you need to get paid subscriptions for multiple platforms, you also have to analyse information across dissimilar sources - some showing you few things built on delayed time-frames, that too in these volatile markets.

We understand that this is time consuming and also costly - you are paying a lot over and above you pay to execute a trade & on top of it, the experience leaves a lot to be desired.

This thought was always intriguing us, why Options Traders have to hop on multiple tabs to just execute a strategy? We want to solve this. And hence we came up with the Options Trader. We launched the first version of Options Trader on mobile app in May '22. We got an overwhelming response from the Dhan community. Since then community members have asked for Options Trader on the web with a Custom Strategy Builder.

Here we are, announcing the public launch of Options Trader Web w/t Custom Strategy Builder

We are continuing the efforts of making products with the Dhan community, we have given exclusive access to select few Dhan users for Options Trader beta version. We got feedback & appreciation and made a few changes. Below is the comprehensive list of features you will get on Dhan Options Trader (https://options-trader.dhan.co/).

- Custom Strategy Builder

- Strategy Snaps to adjust your Strategies (industry first)

- Fast Create 14 Popular Strategies

- Pay-off Graph

- Auto-Refresh Strategies

- P&L Table

- Strategy Chart

- Multi Strike OI

- Open Interest Bar Chart

- Adjust Target date & price

- Adjust Implied Volatility

- Strategy Greeks

- Pre built Strategies

- Outlook based Strategies

- Movers & Gainers for F&O

- Traders’ Watchlist (industry first)

- In app Order & Position Management

- Real time Price Feeds

- Integrated Options Chain and Underlying Snapshots

All the above features extended to key Indices - NIFTY, BANKNIFTY and FINNIFTY, and also all F&O stocks of your choice.

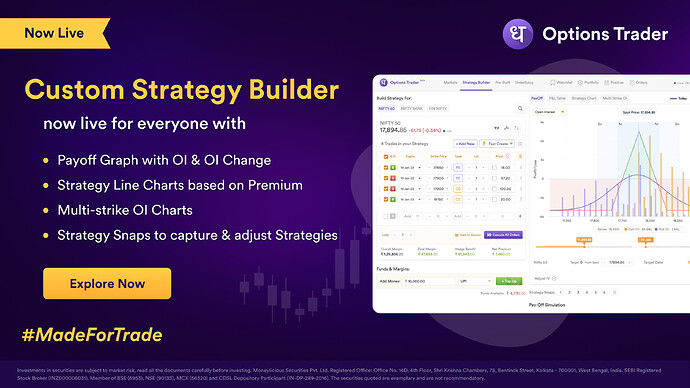

Custom Strategy Builder on Dhan

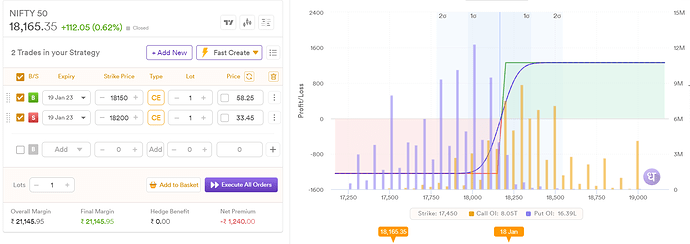

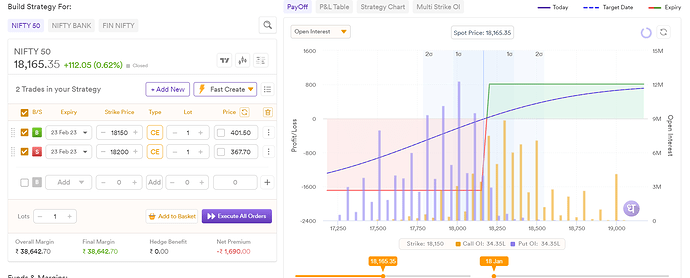

Creating options strategy, visualising it with graphs & charts and executing with lightning fast speed is now on your fingertips. Easily build any options strategy here. Nifty, Banknifty & Finnifty are pinned as these are the most tradable instruments. You can quickly hop between any of these instruments. There is a search icon to build strategy for any other F&O stock. The selected underlying will display as heading with its live prices and quick shortcuts to open Options Chain, Fullscreen Charts and tv.dhan.co.

We preload bull-call spread by default. One can load any strategy from the drop down list of Fast Create. Or if you want to add a leg in strategy, simply click on Add New. A compact version of Futures & Options chain will open, select the desired leg for your strategy. There is one more way to add legs in your strategy. Simply tick mark the checkbox of the greyed row in the input box, make changes and click on + button.

Once you add a leg, you can again change the transaction type (B or S), expiry date, strike price, options type (PE or CE), number of lots & limit price. You can change the order type ( limit order to market order) by simply clicking on the check box in the price section. To get the latest trading price of the options leg, you have to click on the Refresh icon on top of price. Also, to change the product type (normal to intraday), you can open the drop down menu besides fast create. The default product type is Normal.

Not only this, you will find more options in the three dots menu like market depth, charts, add to watchlist & basket, setting price alert or delete. You can change the sequence of legs by simply drag and drop. Your orders will be executed in the same order as you arrange them here. Below you can see the margin requirements to execute this strategy.

Overall Margin - Minimum margin required to successfully place & execute this strategy.

Final Margin - Margin blocked or consumed from your trading account after successfully executing this strategy.

Hedge Benefit - This difference of Overall Margin & Final Margin.

Net Premium - This is the net amount of options premium to pay or receive. This amount will be settled in your ledger EoD and available for trading from next day. If net premium is positive you can use that amount for options buying in the current trading session.

Strategy PayOff Graphs

Once you are ready with the strategy, you can see its pay-off graph on the same screen. The X-axis is the price scale of underlying and the Y-axis is the P&L scale. There are three types of lines plotted on Pay-off Graph :

Expiry Line - This is a Red-Green colour line. This plots the P&L on expiry day wrt underlying prices. In simple words, this tells you the P&L of your strategy if the underlying prices reach a particular price on expiry day.

Today Line - This is a solid blue colour line. This is an estimated P&L of your strategy if the underlying price reaches a particular price today.

Target Line - This is a dashed blue colour line. This appears when you change the Target date other than today. This is an estimated P&L of your strategy if the underlying price reaches a particular price on target date.

PS : Today Line & Target Line is theoretical value and plotted using Black-Scholes Model.

Open Interest Bar Charts

With Options Trader, you can now see the OI Bar chart on top of PayOff Graph. Click on the drop down “Show” on the top left side. Select “Show Open Interest”. You will see a vertical Bar Graph of Open Interest at each strike price for both Call & Put. Yellow for Call OI & Purple for Put OI. Not only this, you can also see “Change in OI” here. This OI change is with respect to the previous day.The right side vertical axis is scale for Open Interest.

Target date & Target price

There is a slider available below to change the Target Price & Target Date. This will make changes on the PayOff Graph and P&L table. It will give you a theoretical P&L estimated on that price on a target date.

Adjust Implied Volatility

You can change and adjust the IV of the whole strategy or individual options contract in the strategy from here. Based on the adjusted value of the IV, the PayOff & P&L table will be plotted. Again, this is estimation calculated based on Black-Scholes Model

P&L Table

Using this you can visualise & track the P&L of your strategy if executed at price mentioned in the input box. Not only this you can adjust the target price (spot price) and estimate the P&L.

Strategy Chart

These are the line charts of the strategy you have created. This is calculated based on simple addition & subtraction of the premium of each option contract in the strategy. Along with the strategy chart, you can also see the line chart of the underlying. You can hide any chart by clicking on its legend below.

Multi-strike OI

You can visualise and track the Open Interest of multiple options contract together. The OI line chart of all the options loaded in the input box will be plotted here. Using this feature one can easily track the activity of multiple options and pick one suitable for their strategy.

Strategy Snaps

This is a very unique feature we have come up with options-trader.dhan.co. You can capture the current state of your work in strategy builder using this feature. To capture the current state simply click on any grey coloured tab. You can make any changes now you want and save the new state in another grey tab. Once you capture a state in a tab, the colour changes to purple from grey. To open the previously captured state, click on any purple tab. The previous state will open and tab colour will change to orange. You can again make changes here and capture it in all together different tab. To repeat the colour pnemonics, the grey tabs are empty, purple tabs are filled and the orange tab is opened.

The strategy snap can be useful in many ways:

- You can create and track mutiple strategy.

- You can create and save the different adjustments of same strategy

- You can be ready with hedge leg adjustments of your deployed & executed strategy.

- You can use snaps to track Multistrike OI of few more legs , strategy chart on other legs and payoff of different strategy

Its utility can be numerous, traders of different styles can use this in different ways.

PS: This is not stored in the server, this is valid only for one session. So once you log-out or change the underlying, all your strategy snaps will be deleted.

Pre-built Strategies

These ready made strategies of options for F&O stocks and tradable indices. These strategies are divided into 4 major categories.

- Bullish

- Bearish

- Non-Directional

- Any-Directional

The list of strategies has a detailed view of data like max profit, max loss break even points and details of each leg in the strategy. There are a total of 14 strategies available. You can either open this strategy in builder or save as basket or simply execute in single click.

Outlook based Strategies

You can input your view or outlook and options-trader.dhan.co will show you the list of strategies matching your outlook. Again you can either open this strategy in builder or save as basket or simply execute in single click.

Movers & Gainers

Movers & Gainers for Options & Futures like most active contracts, OI Gainers-Losers, Price Gainers-Losers

Traders’ Watchlist

Watchlists here are synchronised with all dhan platforms. But the expanded view of the watchlist at options-trader.dhan.co is different. We have created a Traders’ Watchlist which has more data columns required for a trader to make decisions better. Few of the parity columns are Open Interest, 52 Week High-Low, Best bid & ask quantity and price etc…

Orders & Positions Management

Options Trader has inbuilt orders and positions management and tracking tabs. You can use almost all the order types and position management tools available at dhan here also, like basket order, draft order, forever order, reverse order, and manage position in detail.

This is the first version of Options Trader on the web. We will be back soon with more super cool features and with the same features on the Options Trader app.

Just saying, you need not to pay any extra money to use these features. This platform is free for all Super Traders on Dhan. Visit options-trader.dhan.co or ot.dhan.co to start your options journey with us.

Happy Trading!

Naman

Product @ Dhan