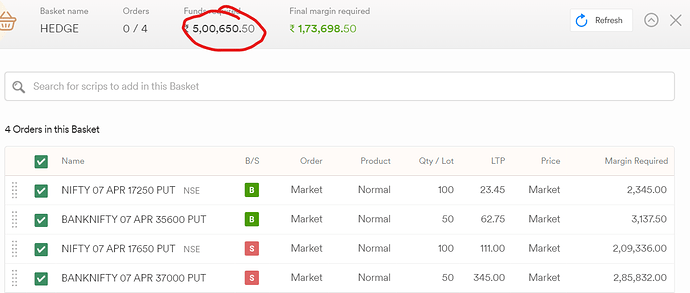

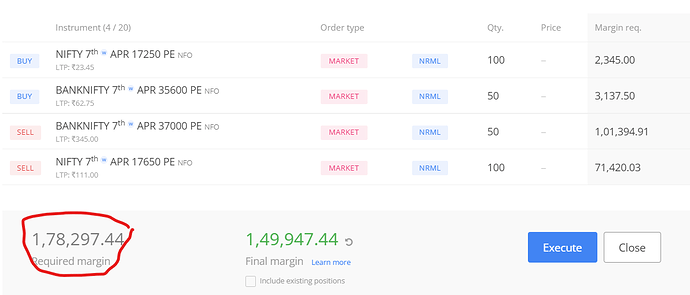

Again you are trying to misled. I am talking about all funds required, final margin required. You are asking to keep 1.69 lacs funds in account for bull put spread hedge. Other brokers like zerodha ask 47k in account for bull put spread hedge. Coming to final margin, that is also different, you have 42K and they have 28K. My problem is about funds required of 1.69 lacs compared to 47k. It is almost 4x different.

You guys are intentionally not answering the issue of funds required to open hedge. I am not much much bothered about final margin.

Hi @vivekbagade

We are absolutely right in the information we have provided on Dhan. Hedge is formed when both legs of the orders are executed and both positions are created on exchange. In case only one leg gets executed of your transaction, and hedge is not formed - the margin benefit is not availed. When both orders are sent to exchange for execution, there is scenario where one gets executed and other does not. On Dhan we show ‘funds required’ for this scenario, which covers for both.

For ‘Final Margin’, where you are comparing 42K on Dhan v/s 28K on other brokers, they are reducing the premium to be received and hence showing you a lesser final margin. It make you feel its less margin to place a transaction.

We show the actual margin required as per exchange specification and we wouldn’t be comfortable showing it any other way than what is prescribed by the exchanges.

I was raised this question first. If many people noticed the same issue then where is the problem.?

I don’t know who is the beginner here .

I was quite disappointed with this platform ( slow orders, ema zigzags,et

c) and margins and also their replies…

And, they were talking about sending orders and what if 2nd order executed first without proper margins… so that’s how i realised that how this platform works and system works here.

If you see in mobile app, while executing the basket order, there is an option " execute with 1st order"

Then how will the second will execute first.

May be if any glitches happened, no one will responsible for your money…

We all informed same thing again and again, every time the reply was same.

So i concluded myself, it’s better to stick with top brokers and don’t need any arguments about their system and don’t waste your time and money by shifting one to another.

hi @Jp007

We answer all the questions asked honestly and transparently here. Margin requirements are shared by the exchanges and are same for all, and are calculated and reported - its same rule for all stock brokers. All systems are audited and certified by exchanges.

Order execution does not depends on any broker, it depends on the exchange. When two orders are sent to exchange at same time, its execution at exchange depends on multiple factors like price, liquidity and multiple, I am sure you would know this.

On Dhan web also, you have option to select one order only and execute it individually. Users on our platform - execute both legs of the order together… many have more strategies in a basket - where they choose to execute first and wait for the next.

We clarified your query on Margin Calculation, I also replicated your order format with Limit order on another platform you mentioned, it got rejected. Acknowledged that sequence of orders, margin requirement should change as per your feedback and we are working on this.

You guys are intentionally not addressing the issue. Keep your logic to yourself. We customers are very much knowledgeable.

Hi @vivekbagade & @Jp007

We will improve the communication here and make changes to ensure there is no confusion on ‘Funds required’ and margin required. Additionally benefit for options traders, will be highlighted separately.

Finally you understood the traders view, if you fix this issue i will definitely comback to you…

Thank you

I just did a ATM straddle for Bank Nifty at Dhan as well Zerodha. Same lot, same strike price, same expiry.

Margin used at Zerodha (after giving back instant credit of the premium that is received by selling options) stands at 282750

Margin used at Dhan (after giving back instant credit of the premium received by selling options) stands at 327443. While Dhan has given the premium back to the account but while showing Margin used, it continues to show the original margin required. Rest, it is not asking extra margin as interpreted by looking at the margin used on the screen.

Nothing to be checked. I just shared the understanding which traders at Dhan are missing.

Let me rephrase.

Dhan is asking Margin in line with other brokers. Dhan is also providing instant credit of the premium received on options sold like other Brokers. The only difference is that Dhan is displaying the original margin used whereas other brokers are displaying net of premium received under Margin used.

Thanks @nity, we will make the communication clear and simpler in coming release (one after next). Your feedback has been very helpful always.

At last you have put an end to the query,.

Thank you to all the users who faced the margin issue and raised query here, initially they thought i was wrong and their system and rules were correct, now I thought they would realize the main issue of their system.

I posted this question when I created my Dhan account the first week of Feb, they said the same thing, again I posted this query the first week of march they said the same thing.

Now its April 1st week, still

As of now, there is no updates regarding this issue. People posting the same query again and again in these days, but still no updates.

its been 2 months not a single day or week ro month. let’s decide yourself what to do.

Most broker allows users to trade with the premium collected when you write an option, in your case it’s (28800) for the option contract sold… and you have paid some premium in buying options (~5482)

Total premium collected by you =28800-5482= 23318

So you minus that with 173698 shown in Dhan … You get approximately the same amount

Zerodha does deposit the premium collected and hence you can use for other trades and so many other brokers, but some brokers lock this amount and you can not use for other trades, this may be the case with Dhan

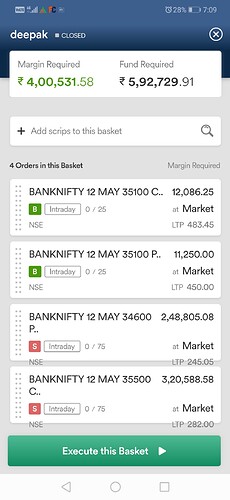

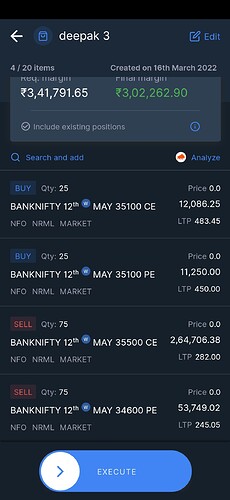

Dear JP. Same thing is happening to me. I asked the Costumer care about this but they replied you need the margin required to exicute the order. I think either they don’t understand our question or they have never traded in top discount brokers like zerodha, Angle or fryers. For a same hedging trade i need 3.5 lakhs in zerodha where as in dhan it shows fund required ia 8.82lakhs. They are charging the same brokarage as zerodha then why i will put 8.82 lakhs in dhan account to take the same trade that i can take in zerodha in 3.5 lakhs. I have just opened the account but i won’t trade till they don’t resolve the issue.

That’s better, and I hope you never trade in this life

You can check here the timeline of this query.

I think they have made this basket order option for buyers only those who trade more than 50 lots as they can’t do in a single order due to SEBI limitations. Nothing for sellers here. I have opened a lot of accounts in other brokers and i want change my broker(zerodha) but believe me i am trying for last one year but i am not able to change because no other brokers give the facility that zeeodha give:grin:

. Hope in future some broker will give such facility with less brokarage.

. Hope in future some broker will give such facility with less brokarage.

Hi @Jp007 @deepak9012 @Vignesh_N @amit @nity

We have updated the basket experience. Please go through this link and share your feedback…