Hello Traders,

We continue to constantly take feedback from our users in our aim to improve our product & services and offer you an unmatched experience on Dhan.

At Dhan, we provide Margin Benefit on 1450+ stocks and also packed with best-in-class pledge experience. With Dhan you have the ability to instantly Pledge / Unpledge, sell in-line without requiring to unpledge first, get Margin Benefit for Options Buying, availability of margin benefit across all segments including Currency & Commodities, Real-Time Margin benefit calculation and lots more.

We received feedback from some of our community members to provide additional margin for select Cash & Cash Equivalents. While evaluating this request, we also looked at some power users on Dhan who are using Pledge Margin Benefits for trading.

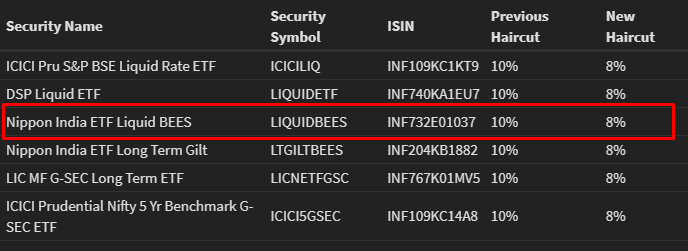

To provide a better edge to our traders, we have now revised haircuts for margin on some popular securities, list mentioned below:

| Security Name | Security Symbol | ISIN | Previous Haircut | New Haircut |

|---|---|---|---|---|

| ICICI Pru S&P BSE Liquid Rate ETF | ICICILIQ | INF109KC1KT9 | 10% | 8% |

| DSP Liquid ETF | LIQUIDETF | INF740KA1EU7 | 10% | 8% |

| Nippon India ETF Liquid BEES | LIQUIDBEES | INF732E01037 | 10% | 8% |

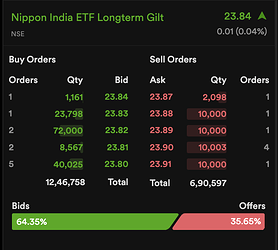

| Nippon India ETF Long Term Gilt | LTGILTBEES | INF204KB1882 | 10% | 8% |

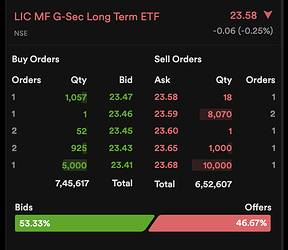

| LIC MF G-SEC Long Term ETF | LICNETFGSC | INF767K01MV5 | 10% | 8% |

| ICICI Prudential Nifty 5 Yr Benchmark G-SEC ETF | ICICI5GSEC | INF109KC14A8 | 10% | 8% |

While on this topic, If you are not fully aware of the incredible features and benefits on Margin Pledge on Dhan, we request you to spend couple of minutes on this post: Full post: Margin Benefits & Pledge Shares Experience for Trading on Dhan

We hope this will be helpful for our traders on Dhan.

Thank you

Shrimohan