Hi,

I am wondering if I can manage multiple portfolios in a single dhan account where in

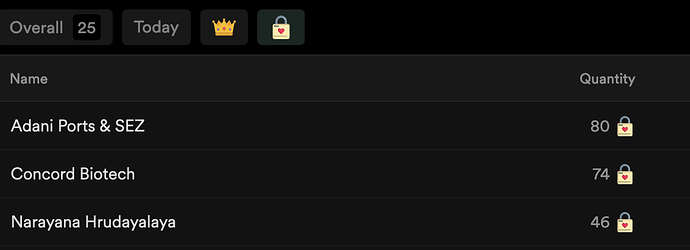

- each portfolio has group name or group tag and there by can be looked in with an expanded view of holdings or contracted view on the group holdings.

- with or WITHOUT smallcase, I would like to make sure when I am touching the holdings in a particular holding group, they should not have any relation or impact to other holding groups

scenario: portfolioA might have few common scrips to other portfolioB or portfolioC - I looked at the API (Portfolio - DhanHQ Ver 1.0 / API Document)

– it looks like all the holdings are grouped together into a single portfolio — this could have bad ramifications, as I intend to manage seperate portfolio cases in programmatic means for some of the portfolio atleast.

(unfortunately, smallcase is not offering programmatic means to curate and manage the portfolios through programmatic means for personal portfolio/cases, so I intend to rely on Dhan API as much as possible and at the same time making sure the holdings of one group are not affected by the actions in one group – lot of calculations could changed such as %allocation overall)

but I rather would have a leading brokerage here trail blaze the path and efforts for Indian retail trading community.

but I rather would have a leading brokerage here trail blaze the path and efforts for Indian retail trading community.