Recently I came across an article : What’s driving the growth of Options-Trading on Nasdaq’s blog by Phil Mackintosh, Chief Economist and Senior Vice President at Nasdaq who has done a detailed analysis on the Growth of Options Trading in the recent years.

US Markets:

A data point highlighted in the article is worth to be pondered upon:

- The options market in US trades around 40 million contracts. In 2010 it was 15 Million and it was less than 2 Million in 1999

Few of the reasons why there has been in a rise of Options Trading in US:

- Increased market volatility that we’ve seen, which has made options an attractive tool for hedging risks or taking advantage of market movements.

- Availability of lower trading costs and greater access to trading platforms, which has made options trading more accessible to retail investors

- The availability of new and innovative products, such as weekly options, which has attracted more traders to the market.

- Greater financial education and awareness among investors, which has led to increased interest in options trading.

Indian Markets:

Similarly, while researching on the increase in the Options Turnover we came across an article: Indian Exchanges – Rise Of Options Turnover by 2Point2 capital, where the reasons for the increase in the turnover matched with that of the US Markets.

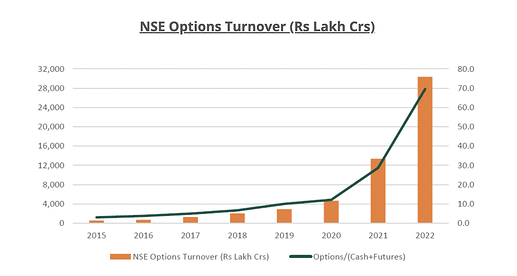

As we can see, the NSE Options turnover have consistently increased with a major catapult seen during the Covid lockdown period.

NSE’s options turnover has increased 50x over the 2015-2022 period. Options turnover which was 3x that of the combined Cash and Futures volumes in 2015 has increased to 70x in 2022.

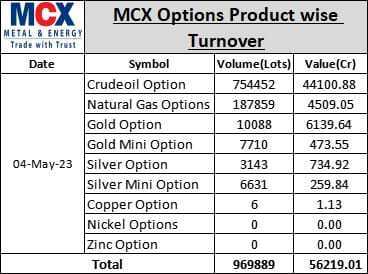

Similarly, it’s observed in the MCX Futures & options Turnover too. And right now, MCX has more 7 commodities options to Trade into.

One interesting note here is that: Unlike US, India levies STT ( Security Transactions TAX) on the value of securities traded on the equity (STT) and commodity (CTT) exchanges. This tax increases the transaction costs, making it more expensive for investors to execute trades. STT/CTT can make several investment strategies unviable due to the higher effective costs. Yet there it hasnt deterred a lot of traders.

Similarly, the business effects on the NSE & MCX has been massive. In the article it quotes that, “For NSE, options trading now accounts for ~85% of its transaction income. This number was less than 35% just five years back. This has been the biggest driver of the increase in NSE’s turnover (3.3x) and profitability (3.5x) in the last 3 years. It’s no surprise that NSE’s share price ( unlisted share price) has increased from 850 in June-2020 to as high as 3500 in December-2022.”

BSE has also announced a change in their Tick Size to capitalise on this increased demand. We would have to see how it pans out.

And as always, it is important for investors to do their due diligence and carefully consider the risks and benefits of any investment strategy. The rise of options trading presents both opportunities and challenges, and Investors/Traders should be prepared to navigate this complex market.

What do you think about the rise of options trading? Are you bullish or bearish on this trend? Let us know your thoughts on the increase in the Options Trading.

Quirky fact: In US there are 16 stock market exchanges.

Disclaimer: Trading and investing in the securities market carries risk. The Content is for entertainment and informational purposes only and you should not construe any such information as investment, financial, or other advice. Data and information is from publicly available sources. Please do your own due diligence or consult a trained financial professional before investing or trading. Don’t take this post as investment advice, it’s purely meant for educational and entertaining purposes only.