Note: This strategy is mainly used by institutions / banks for their “short term” funding requirement. To effectively deploy this strategy, HFT servers on Colocation are preferred.

Aim: To borrow money from the stock market at lowest rate of interest. The interest rate could even be NEGATIVE.

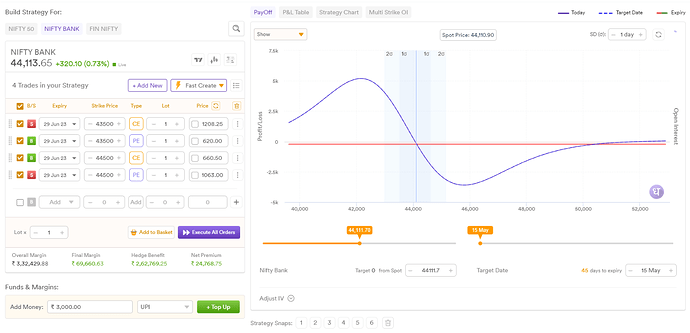

Mechanism: The strategy is commonly called a “Short Box” options strategy. In this you sell the synthetic future of the lower strike price and buy the synthetic future of the upper strike price. For those who are new to the term, to buy a synthetic future you buy the call and sell the put while doing the reverse for selling a synthetic future. In other words, it’s the combination of Bull Call Spread and Bear Put Spread, having the same strike price and expiration date. Let us check this strategy practically:

Here you can see that the loss in this strategy is fixed at Rs. 231.25 and you get Rs. 24,768.75 on the T+1 day. Now, at the time of expiry, you need to pay Rs. 24,768.75 + 231.25 = Rs. 25,000 back to the market. In layman’s terms, you borrowed Rs. 25,000 from the market by paying upfront interest of Rs. 231.25 for the tenure of 43 days (T+1 to E-1). This translates to an annualised ROI of (231.25/24768.75)*(365/43)*100 = 7.92%.

Now here is the catch, BANKNIFTY is mainly chosen in this regard as it is more volatile and volatility brings in dis equilibrium in the prices. This dis equilibrium translates into the interest being even NEGATIVE at times due to volatility.

For this, the collateral blocked would be of Rs. 75,000 approx and since this is a pure arbitrage strategy, there would be no major impact on the additional margin requirements.

Banks and PTD have algo systems in place to identify the available strikes (usually built over Bloomberg Terminals). The replicative of this I have taken live exchange feed from backend and curated in Excel and this looks as below:

Banks and PTDs have an edge on this as their trading costs are almost zero and they have sufficient collaterals in terms of BGs.

Disclaimer: Trading and investing in the securities market carries risk. The Content is for entertainment and informational purposes only and you should not construe any such information as investment, financial, or other advice. Data and information is from publicly available sources. Please do your own due diligence or consult a trained financial professional before investing or trading. Don’t take this post as investment advice, it’s purely meant for educational and entertaining purposes only.

Do share your comments on this.