Trading Strategy Case Study #4

Aim: Earning alpha using Government Securities and Index Options

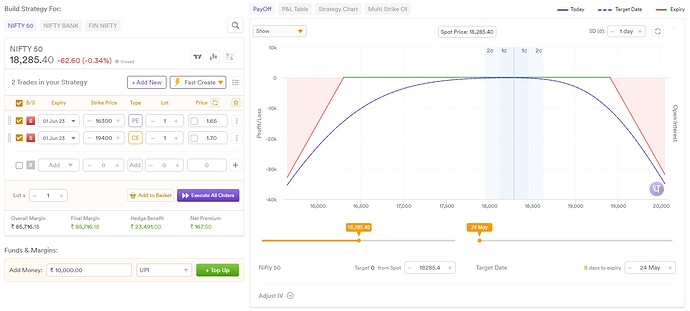

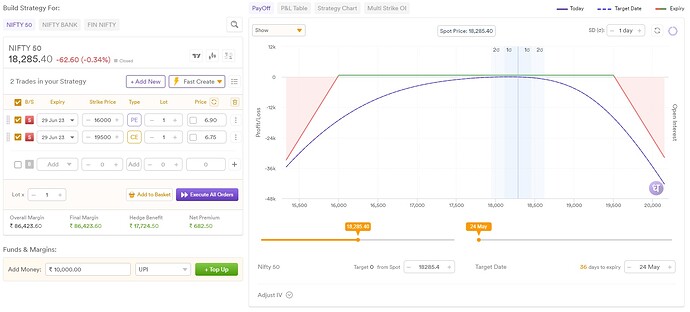

Mechanism: The scope of the strategy is to use Government Securities as collateral and using them as margin, sell index options (NIFTY) to generate alpha. The strategy is commonly called a “Short Strangle” options strategy.

Flow:

- Buy Government Securities worth Rs. 1,00,000. Roughly, the yield is around 7.5% currently.

- Pledge them to get margin. With 10% haircut, you will get a margin of around Rs. 90,000

- Now sell lower strike put option and upper strike call option in NIFTY to get premium.

Follow the below mentioned calculation to identify the strikes.

| Capital |

1,00,000.00 |

| ROI Required (A) |

15.00% |

| Underlying (B) |

7.50% |

| Additional Return (A-B) |

7.50% |

| Additional Return in Amount (C) |

7,500.00 |

| Monthly (C/12) |

625.00 |

| Weekly (C/12*4) |

156.25 |

Now either go for weekly, monthly or long term based on the premium needed and choose the strikes.

For weekly, we need a premium of Rs. 156.25. As NIFTY lot size is 50, we need the straddle premium of Rs. 156.25/50 = Rs. 3.13. Now go to the option chain to select the strikes such that the total strangle premium is equal to Rs. 3.13.

Similarly for monthly, the strangle premium = Rs. 625/50 = Rs. 12.5 and for annual, the strangle premium = Rs. 7500/50 = Rs. 150

As you can see from the payoff graphs that the range is too wide to get breached (black swan events are exceptions). So you will consistently make a gain of 15% if you follow this with discipline. Based on your risk profile and return expectations, you can adjust your calculations.

Insights: In PTDs, such strategies are deployed on a large scale (around 1000-2000 lots each desk). However, as the strangle strategy carries unlimited downside risk, a strict SL of thrice the option value is placed as SL which helps to protect from any black swan events. The same can be followed as a measure of protection.

Insights: In PTDs, such strategies are deployed on a large scale (around 1000-2000 lots each desk). However, as the strangle strategy carries unlimited downside risk, a strict SL of thrice the option value is placed as SL which helps to protect from any black swan events. The same can be followed as a measure of protection.

5 Likes

Am not a fan of overnight sell strategies with unlimited downside. Worst case risk is account khali

Pledging govt securities and doing expiry day otm selling with stops would be less risky.

1 Like

@t7support Indeed the risk exists and hence we followed a strict SL of 3 times the option value. Back then, we had SL order which used to get triggered as soon as market opens from the RMS side. However, I had rarely seen that taking place, we used to close positions on any such major events.

Expiry day OTM selling my entry point in PTDs when intraday leverage was 100x and more. Good olden days

SL work only when the market is live. It doesn’t protect against overnight mayhem. At market open one can exit only at available market price.

This is true. This makes sellers happy most of the time. But one really bad day which may happen once in a decade could take away years of hard earned profit.

True. Sellers are rewarded premium only only because they carry the baggage of this risk. Hence, PTDs diversify their risk by allocating a big chunk of funds in different desks. I remember during March 2020 expiry, the strangle desk had losses of 47 cr. However, the other desks had managed to be profitable and overall the expiry ended positive. Having said this, this equation doesn’t work for the retail where the capital is limited. PTDs enjoy almost infinite capital.

Yes. The logic was as soon as the market opens, buy order was placed at thrice the option premium. The very first order from our desk.

2 Likes

@iamshrimohan sir

For how long (period) can I use collateral margin if i sell options?

Can it be used for month/2month or year?

What are the charges for of collateral margin?

Is collateral & MTF is same?

@KomalRani I am unable to figure out your query. However, explaining the generic flow of margin and option selling, hope that helps.

-

If you sell an option, you would need an upfront margin and the premium collected by you will be credited to your ledger on the next trading day. The margin will be blocked until you square off your option position. Now at Dhan we allow options of next 270 days to be traded.

-

For collateral margin, you need to pledge your securities against which we give trading margin. The charges for pledge are Rs. 12.50 + GST per ISIN per instruction.

-

MTF is different from collateral. MTF is basically loan that Dhan gives you for buying some selected stocks. It is not for FNO.

Hope this answers your query. IF not, feel free to elaborate in the same thread. Alternatively, you can also reach out to our customer service or drop an email to help@dhan.co for further assistance.

Ok sir,

Understood that Govt securities can be pledged and collateral can be used to sell options. Pledging charge is 12.5 + gst, is there any othe charges involved?

Is there any other requirement to keep Cash in demat a/c or only collateral margin can be used completely to sell options?

Thanks for clarifying above doubts.

Can you pls explain how to buy upcoming G-Sec in dhan?

Hi @KomalRani at present we do not have a G-Sec bidding platform on Dhan, we are actively working towards building an entire module for Bonds, it will be launched along with that. However, you can sign up on NSE goBID and Sign-up for Existing Clients of NSE Trading Member using Dhan BOID which is a 16 Digit Number. Remember to select broker as Moneylicious Securities Private Limited. Once done, you can apply for bids from the NSE Portal and the units will be credited to your Demat mapped with Dhan.

2 Likes

Thanks sir fot the update.

Hope to see the G-sec bidding platform on dhan soon.

Keep growing.

@iamshrimohan

Hello sir,

Kindly clarify the following

-

Is there by any chance we can have/ open FD’s via dhan platform?

-

Is there a provision to invest in MF via dhan platform?

3.And can we get cash collateral margin against these FD’s or MF’s to trade in option selling ?

- If FD/ MF option is not there in dhan, is there any plan in near future to have these features on dhan platform,?

Thanks.

2 Likes

Most users will not have the stomach to do this strategy. Can you rework to an iron condor and assess the annual returns?

That way more users can commit and replicate.

Hi @KomalRani,

Currently you can only invest in stocks & equities and trade in F&O through Dhan platforms. We will be soon bringing in Mutual Funds on the Dhan app.

Rest of the details will be shared soon as well.

hi @viswaram

Our trading strategy case study posts are only meant for educational purposes, and intend to discuss more on finding the drawbacks and limitations of it.

We don’t provide any services or strategies through which the users can apply on their own trading systems.

@iamshrimohan Kindly forgive me as i’m beginner in F&O, in case of loss (realized loss on expiry day) while executing this kinda strategy (with index options) is it better to keep additional cash in trading account (as a buffer and settle the loss with cash) or would the cash equivalent that i pledged (in the case you have put up government bonds) would be sold from brokers end and my losses would be covered?

Would there be any notification to me in such cases to add additional cash from brokers (Dhan) end by EOD? Also if there is notification and i add additional cash by evening 5 pm of the day of expiry would i face any DPC (if not 5 pm is there any specific time before which i need to add funds in these cases)?

@viswaram I missed your message. For iron condor, you can apply the similar strategy, only difference is you need to factor in the option buy premium. Usually with this strategy I have generally observed the strikes to be beyond 2 SD which makes approx. 99% profitability. So option buying will only reduce the return.

@ValueInvestor0 Keeping cash to cover the MTM loss is an old thing. We allow instant pledge. So why to park you ideal money as CASH, you can buy G-Sec and enjoy the passive income until you face any MTM loss. Incase any loss comes up, you can sell the security. We would be intimating you at the BOD regarding any shortfall.

![]() Insights: In PTDs, such strategies are deployed on a large scale (around 1000-2000 lots each desk). However, as the strangle strategy carries unlimited downside risk, a strict SL of thrice the option value is placed as SL which helps to protect from any black swan events. The same can be followed as a measure of protection.

Insights: In PTDs, such strategies are deployed on a large scale (around 1000-2000 lots each desk). However, as the strangle strategy carries unlimited downside risk, a strict SL of thrice the option value is placed as SL which helps to protect from any black swan events. The same can be followed as a measure of protection.