Hi All,

On Dhan, we continue to build and make our investing & trading experience better everyday. We actively listen to feedback from our users and ensure we act on it to make Dhan work for you.

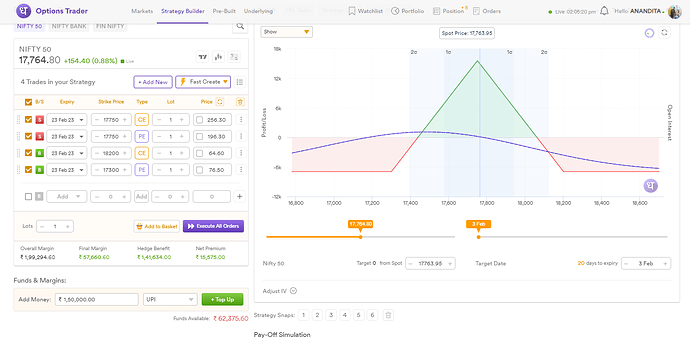

With Basket Orders, you can execute multiple orders together. Traders on Dhan are loving the basket orders experience, we extended this to TradingView and to Options Trader app as well (signup for early access, if not).

We have further enhanced the basket orders experience, specially around margins and are set to go live with the following enhancements soon on Dhan Web, App and TradingView.

1. Margin Requirements:

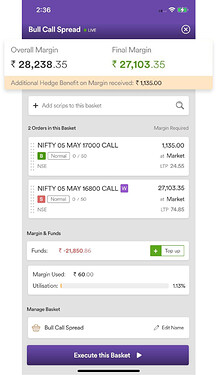

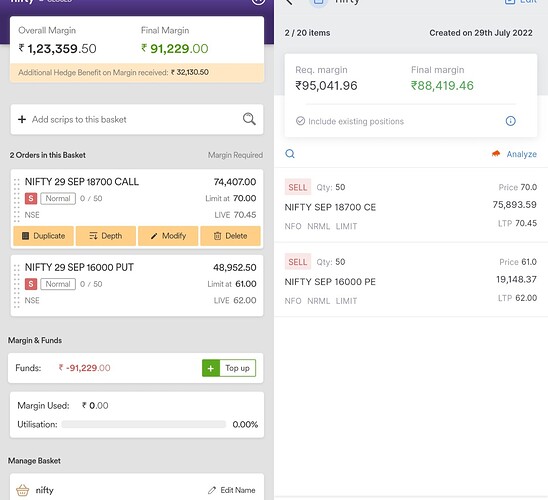

Option Traders use basket order to get margin benefits from hedging legs. We are now showing required margin and hedge benefit upfront:

Overall Margin: It is simply a sum of margin required for each leg to execute in the particular sequence. This is the minimum amount you need to have in your account to successfully execute all orders of the basket.

Final Margin: It is the final margin blocked after all the order in the basket is executed.

Hedge Benefit: This is the difference b/w Overall Margin & Final Margin.

We were earlier showing Overall Funds, which led multiple times to confusion with Final Margin. We have now updated this to make it more simpler and easier to understand.

2. Rearrangement of Orders in Basket

You can now change the sequence of order in a basket and see the changes in real time margin requirement. This ensures you now see the margin utilisation based on your approach to execution of orders… Buy / Sell and CALL / PUT first or after.

3. Sequencing of Order Execution

Earlier, when you placed orders via Basket, all of them used to get executed together, which resulted in higher funds required - since we had no control on which order the exchange would execute first.

Now, we have moved to Sequence based order execution, which means orders in a basket now get executed in a particular sequence one after the other. This ensures hedge gets formed in exchange positions, as result margins are reduced and also you get the expected experience when it comes to order execution.

We hope with this, you will love the Baskets experience on Dhan even more. These updates are already live in Options Trader app for those who have access.

Enjoy your investing experience on Dhan Thank you.

Naman