Tell us what type of a Trader are you in the comments below!

Swing trader & long term investor

Technical

Swing (Stocks Options Buyer.)

Intraday (Index Options Buyer.)

Intraday Index FnO Trader

Conservative System Trader

Curious to understand! @amit @nnJhavarePatil @CCCB70625

What’s the reason who chose to execute your respective strategies?

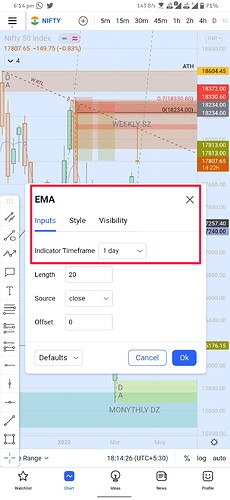

@RahulDeshpande दादा, मी position घेण्यासाठी आणि risk reward मोजण्यासाठी supply-demand zones charts वर marking करून ठेवतो.

कोणत्याही tf चे effective zones शोधण्यासाठी, extended move आहे की नाही हे ओळखण्यासाठी आम्ही EMA 20 D TF चा वापर करतो.

(ह्यासाठीच तुम्हाला अनेकदा मागणी केली होती की, EMA आणि ATR indicator मध्ये indicator tf उपलब्ध करून द्या. Please check attachment.)

(Technical analysis)

Higher time frame supply-demand zones मधून जर price react करत असेल तर तिथून trend line च्या आधारे ट्रेड घेतो.

अश्याप्रकारे intraday आणि swing मध्ये ट्रेड करतो.

Swing trading साठी retracement च्या आधारे ट्रेड घ्यायला EMA 8-20 Daily tf आणि gap up आणि gap down Daily tf वापरतो.

Hey @RahulDeshpande , hope this helps.

Cash Segment OR FnO

FnO is obvious choice since we get 80% leverage and for remaining 20% margin we can use pledging to bring the overall expenses further down by making small returns on those pledged investments. So, basically trading with free money (but provided the strategy has real edge and you’ve self control).

Single OR Multiple scripts

Compared to a single script, more script means more work and less confidence. One strategy would have different results on different scripts. So, best is to focus on one script.

Stock OR Index

Index FnO are more liquid than stock FnO.

Trend Following OR Sideways

Trend Following can give good returns provided selective bets are taken as per the system.

Intraday OR Positional

Compared to Intraday, Positional FnO requires a huge account as MTM swings in positional FnO will also be larger. For small account, positional trading in cash segment is better (I’ve separate trading account for swing positional trading in cash segment).

Scalper, Intra-day trader, swing trader