Why Dhan taking more margin than other brokers like zerodha.

Is that the issue raised by P R Sundhar ?

Hi @pulsetrader

Please note that the exchange margin requirements are always Span + Exposure, and on Dhan we follow the same metric and that’s a mandate for all stock brokers.

The reason you are possibly seeing the difference when you compare with other brokers is because they might be or actually reducing the premium to be received from the upfront margin required and that shows a bit lesser value in the final margin. However this is a notional benefit shown to reduce upfront margin. Please note that this premium to be received, will be realised on T+1 day and the amount is credited in the ledger only, but not reduced from margin. So the next day, the margin used will be the same as the previous day and the premium difference will be credited in the client ledger itself.

Margins now are standardised across all stock broking platforms. It’s just a method few brokers possibly use to show a notional lower amount upfront. While you may feel the margin is different or lower than on Dhan, but this is what I am assuming is happening in their calculation v/s the one we show on Dhan. We are not sure why this is done, we show the actual margin required as per exchange specification and we wouldn’t be comfortable showing it any other way than what is prescribed by the exchanges.

Hope this clarifies.

Hi @PravinJ

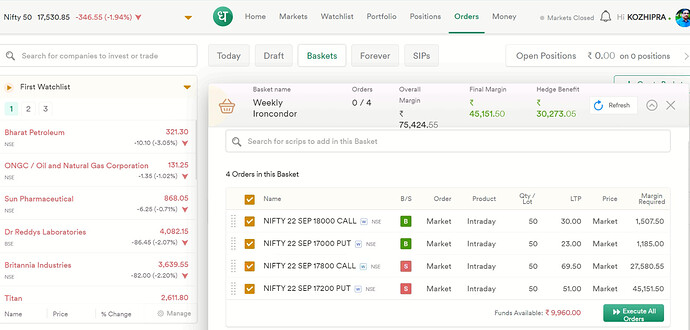

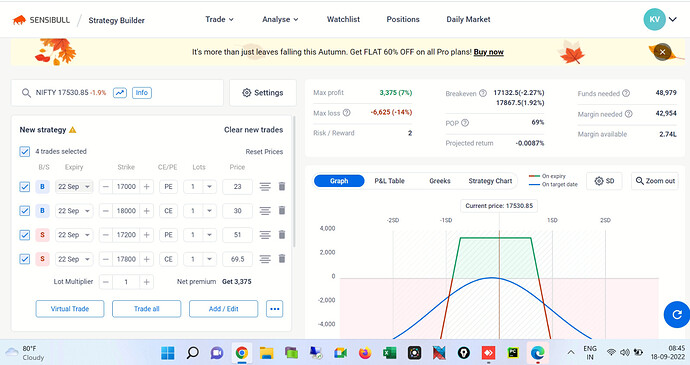

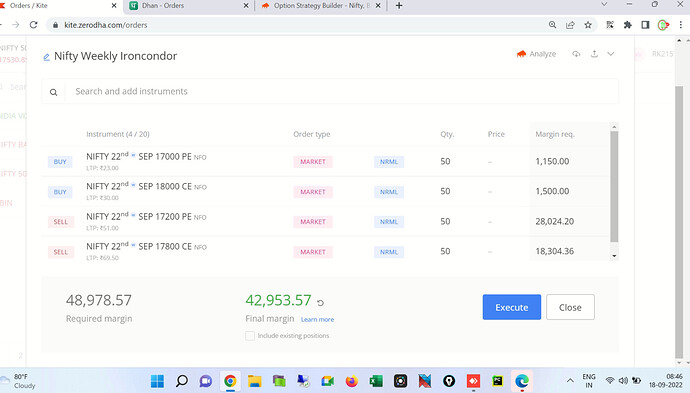

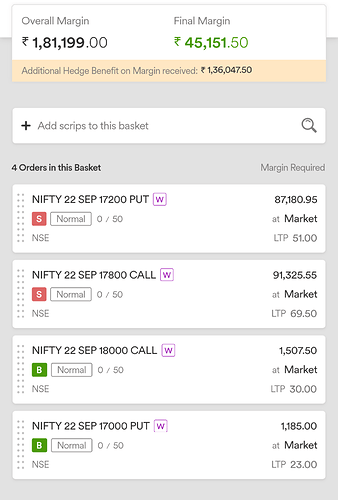

Pls see the pic below. 18000 call LTP is Rs.30. So margin should be 50 x 30 Rs.1500. Similarly 17000 put should be Rs.1150. Why is the margin shown slightly higher on long legs ?

-

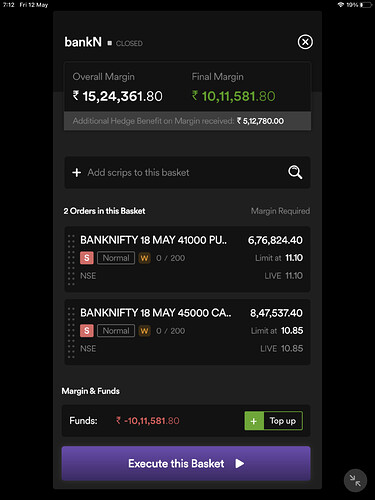

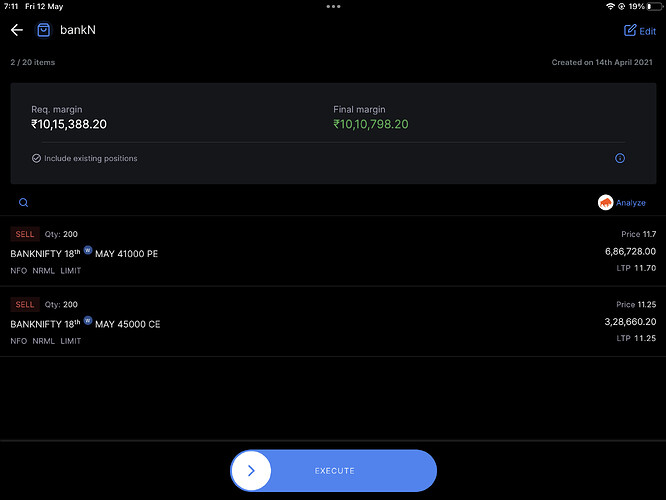

shows a bit lesser value in the final margin////:-- Do you think that its a lesser value from my screenshot. Dhan need nearly 75k for executing the strategy shown and zerodha need only 50k- if am trading with 1.5 lakh - i can trade 3 lots in zerodha and 2 lots in dhan, is that a lesser value ? if i placed order for 3 lots with 1.5 capital in this strategy do my order get executed? You are taking nearly 30% more margin. Is that a bit lesser value ???

-

Margins now are standardised across all stock broking platforms. It’s just a method few brokers possibly use to show a notional lower amount upfront. ////— if the margin is standardized why this difference is seeing ? am ready to take this issue with NSE and Sebi, please give me proper reply in your letterhead then i can approach the authorities very easily. If regulators are standardized margin things to all brokers then there won’t be any difference na, so i can give a complaint against zerodha for not doing standardized procedures.

Hi @t7support

This may be because market price v/s closing price. I will have to check this when once in office (travelling now), will reconfirm.

And also if am entering strategy for Intraday i can take only two lot with dhan and can trade 3 lots in zerodha. Do you think that it is good for traders ?@PravinJ

Yes that seems to be the case. But if you are using day closing price for margin calculation here then why not just show the closing price instead of LTP for the instrument at EOD ?

Let me have this checked again @pulsetrader. Want to ensure you are not seeing data based on bhav-copy or mock trading that happened on Saturday.

Okey waiting for your confirmation.

Hi @t7support, yes was correct here. You could simply verify that correctness by adding the same at Limit Price v/s Market Price. Post market hours, the calculation of margin requirements is based on closing price - hence this value is higher.

Honestly, I really wish most folks were as knowledgable as you are  Everyone thinks LTC at 3:30 PM is the closing price, not many know there is a settlement process in exchanges after closing. On Dhan we show closing prices below scrips along with the time-stamp yet we do get queries from many users that our closing prices are incorrect, as across the board many places 3:30 is shown as LTP / closing price and these terms are also used interchangeably.

Everyone thinks LTC at 3:30 PM is the closing price, not many know there is a settlement process in exchanges after closing. On Dhan we show closing prices below scrips along with the time-stamp yet we do get queries from many users that our closing prices are incorrect, as across the board many places 3:30 is shown as LTP / closing price and these terms are also used interchangeably.

Hi @pulsetrader

Yes, data on Dhan is correct in your case. Overall margins are required on Dhan to execute orders, hedge benefit is available only (when in your case) all 4 orders are actually executed. So as a broker, we will not be comfortable to state that your orders will get executed with margin of 45,151.50. Your margin required to execute all legs is 75,424.55 and when all legs get executed the blocked margin is 45,151.50 and rest is released as the hedge gets formed.

We also checked the specific margin required for 17200 PUT, on this leg Dhan mentions correct margin and as mentioned earlier other broker may be giving notional benefit of margin being lesser because the option premium to be received is removed from upfront margin requirement, which makes it visibly cheaper. But as again what I mentioned, on Dhan this benefit is handled differently.

If you can trade more lots on other broker v/s on Dhan - I would request you will know only if you try the same. We can comment only on risk management policies on Dhan and not for other brokers. Ideally or theoretically at least they should not get executed, and the orders may get rejected.

Thanks @PravinJ. Is the above workable ? If settled price is available for margin calculation why not lets update the LTP field too in the positions page. Currently this happens pretty close to market open only.

Hey, yes that is possible but it’s really difficult to conclude that closing prices will be close to the LTP. It isn’t always the case. If we do at something we are not sure of, even for us and even for traders - their studies, strategies and baskets will go for a toss. We had actually thought of this and discussed when you brought this up for the first time.

Ya closing price may not be close to ltp. I thought for margin calculation you were using the settled price from exchange. Isn’t that the case or are you dynamically computing it till the settled prices reach your end from exchange ?

You are just foolihg the public by charging overall margin which is double of what other brokers are showing when executing short straddle short strangle strategy. If the overall margin criteria is not fullfilled by having that much amount in my account will both the Orders get rejected (CE & PE) when doing a short straddle or will only half the order will get executed. If only half order gets executed then it is dangerous. Dont say that only you are following rules and other brokers ar enot following rules with respect to overall margin and required margin amount. This is a serious matter and Dhan needs to change their thinking soon.

Hi @DARA

Welcome to the Dhan community.

Our team is optimizing this scenario and will update you soon.

Facing same issue. I was thinking about shifting my funds from another broker to do weekly straddle, but dhan is showing around +50% extra margin required to execute the same straddle than zerodha. Few percent difference could be there but 50% more seems to be some calculation issue. Please rectify this issue.