Well, the answer would be slightly in a different direction, or rather, the correct way of thinking.

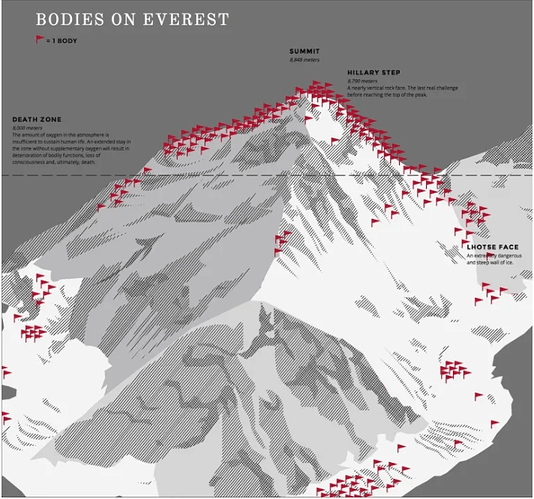

Trading and/or investing is probably the most attractive business that there is on the planet, but it is like Point Zero in the Mount Everest.

Everybody wants to reach Point Zero, but after a certain point the oxygen becomes so thin, the frost gets into your lungs, and the respiratory system is pushed almost to point of collapse.

People who push further that point, 99% of them collapse and die a painful death, however that Top 1% doesn’t break and keep going because in today’s world, it’s easy to confuse genius with madness given so many mediocre people are out there. Mediocrity is the new normal.

Finally, when that Top 1% reaches the Point Zero where oxygen is so thin that you barely breathe at all, that is true pinnacle a trader could be, or rather even be called a trader.

Give it your all, study every indicator, every style, every trader out there. Understand both quantitatively and qualitatively and mould it with your personality.

Summary: Risk/Reward is specific to every individual. Mindset is unique to every individual. You have to develop your own edge, well, to find your edge. Stop listening to outside gyaan and validation. Do what floats your boat, either sink or swim, but with outside gyaan you will definitely sink.

P.S. - I know this is not the answer you are looking for, but this is the correct answer.