Hello Traders,

In just about 2 years, Dhan has introduced many features and enhancements for Traders on its platform - many of them as you know are requests made specifically by our users to better their trading experience on Dhan.

We have always been dedicated to providing you with an exceptional trading experience and our commitment to innovation with you continues. From Custom Strategy Builder for Options Trading, Advance Options Chain, Options Chart on TradingView, Options Analytics and more. We have strived to give you the tools you need to make informed decisions, manage risk better and execute trade faster.

Once again, based on the feedback received from traders on Dhan, we are excited to introduce one of asks from our traders - Long Dated Options Trading or LEAPS on Dhan.

Earlier Dhan permitted traders to to take positions in Nifty 50 index till 9 months only. We have enhanced this and now you have the opportunity to create positions in Options Contracts with expiries extending up to the next 18 months. This addition opens up a whole new dimension to your options trading, allowing you to plan your positions for the long term view into the future. These Long-dated options are available only for Nifty 50 Index.

Now on Dhan, all the option contracts are available for analytics, like expiry till June 2028. But trading is allowed only for the first 18 months. We extend all analytics features including Options Chain, Charts, Market Depth etc.

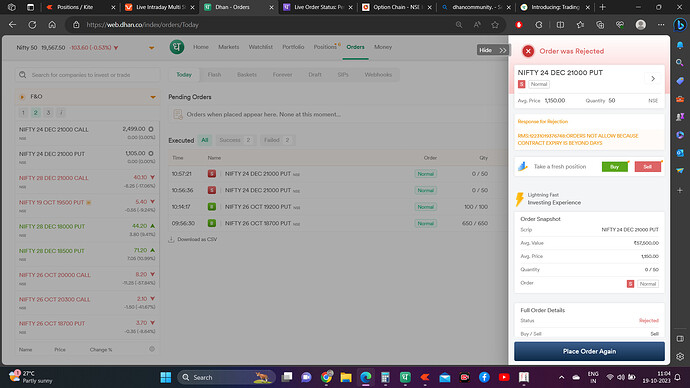

You can trade in any order types - Limit or Market, but since the liquidity in these contracts are usually low so it is recommended to place only Limit orders. For the same reason, we allow only NORMAL (carryforward) positions in long-dated options.

How to Identify LEAPs contracts:

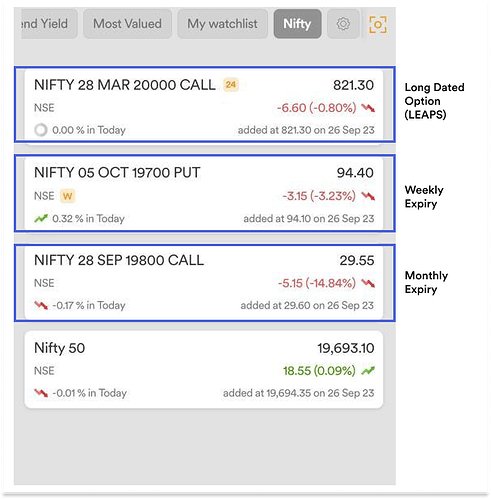

You may notice ‘W’ in front of weekly contracts on Dhan. For contracts of Nifty, let’s say that are expiring in next year September (ie. Sept 2024) will have ‘24’ marked on it. Example of same is below:

Applications of Long-dated Options or LEAPS -

-

Long Term View - LEAPS gives you the greater flexibility for your trading strategies. You can plan your derivatives strategies upto the horizon of 18 months.

-

Portfolio Hedging - Investors with diverse stock portfolios often buy LEAPS put options of index as an insurance against market crashes. If the index rises, these LEAPS options may expire worthless, but dwarf the losses when markets fall and potential losses from LEAPS would be outweighed by gains from the larger portfolio.

-

Diversification - By incorporating long-dated options, you can gain exposure to specific asset classes without the need to directly purchase the underlying asset, thus enhancing diversification and risk management.

It is important to note that while LEAPS offer unique advantages, but they also come with certain risks and costs, including time decay, the premium paid for the longer duration & low liquidity. Therefore, traders should carefully evaluate their specific goals and risk tolerance before incorporating LEAPS into their strategies.

Note: We would suggest trading in LEAPS only for advanced traders only.

Hope you like this update & let us know below in the thread how you are going to use LEAPS in your strategies.

Happy Trading!

Kuldeep Mathur

One who sends you the margin call - RMS Team