MCX Launches Options Contracts for Natural Gas w.e.f 17th Jan 2022. Available on Dhan for trading.

Natural Gas is one of the cleanest sources of energy given its relatively low carbon emissions compared to other fossil fuels. Natural gas has both household and commercial usage. It is used for heating homes during winters in the Western world and US and operating appliances, along with various industrial and commercial uses.

It is also a widely traded financial instrument in energy complexes across the globe next to Crude Oil. Natural Gas is widely traded in the New York Mercantile Exchange (NYMEX), Intercontinental Exchange (ICE) and Multi Commodity Exchange of India Ltd (MCX). The volatility in natural gas prices makes it traders’ favourite. The annualized volatility in prices in MCX was 55% in 2021.

There are various factors that contribute to the volatility in prices. Some of them are:

- US Weather conditions: Extreme Winter increases demand for Natural Gas and price trades higher and vice versa.

- Natural Gas production data: Higher the production lower is the traded price.

- Price of Crude Oil: Higher crude oil prices cause a substitution effect and increase demand for Natural Gas.

- Industrial and Household demand in US and European markets: Higher demand results in higher prices.

- Delivery and distribution constraints: Extreme weather causes freezing of pipelines in the US causing supply disruptions of natural gas, thus resulting in an increase in prices.

- Market rumours: Rumours, speculation cause short term volatility in prices.

- Level of natural gas storage: Increase in inventory levels signals lower demand and thus result in lower prices.

How does the launch of Options trading in Natural Gas help?

Till date, only Natural Gas futures are available for trading in MCX. As we know, futures contracts offer linear payoffs, i.e. the possibility of losses and profits are equally high. Traders cannot hedge their positions and the only way to reduce losses is to square off the open position.

With the forthcoming launch of options, traders get the opportunity to take advantage of the volatility by using various options strategies. The payoffs are non-linear in option contracts that mean losses can be capped while the potential to earn more profits in trade remains open.

Advantages of Natural Gas Options contract:

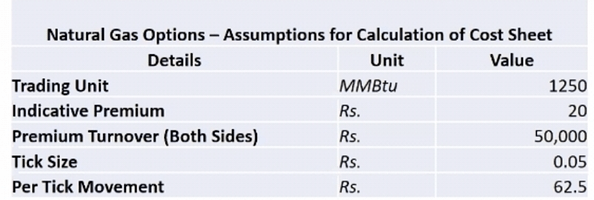

- Low Transaction Cost: The illustration below shows that the breakeven point is at 0.062 which is slightly higher than the tick size of 0.05. At 2 ticks a trader can exit his/her position in profits.

Source: MCX

Cost Sheet for Natural Gas Options:

| Particulars | Cost (per lac) INR | Amount INR |

|---|---|---|

| Transaction Charges | 50 | 25 |

| SEBI Charges | 0.118 | 0.059 |

| CTT | ||

| (Rs. 50/lac) only on sell side | 25 | 12.5 |

| Stamp Duty | ||

| (Rs.3/ Lac on premium turnover paid by buyer) | 1.5 | 0.75 |

| Brokerage | ||

| (Rs. 20 per executed order) | 40 | |

| Total Cost* | 78.309 | |

| Break Even Point | ||

| (Lot size is 1250) | 0.0626472 |

- Cash Settled Contract: Natural Gas options contract would be a cash-settled contract. Unlike stock option contracts there is no risk of physical delivery in case the contract becomes in the money. The contract devolves into a natural gas futures contract.

- Earlier Settlement date: Settlement date for options contract would be 2 days prior to the Expiry Day of the underlying Natural Gas futures contract

- Higher Number of Strike Prices: The number of Strike prices available for trading would be 31 (15 In the Money, 15 Out of Money and 1 At the Money) both for Call and Put options giving flexibility to traders to create their own strategies based on capital availability and risk appetite.

Natural Gas options contract is available on Dhan for trading with effect from 17th January 2022. Trade timings for Commodities on MCX are from 9 am till 11.55 pm.

And also if you do not know, the Dhan app has all Options & Futures available on MCX for trading, with all market-leading features like - Open Interest, simplified order placement, Positions Management, Margin & Leverage, Options Chain and much more.

Start Commodities Trading on MCX via Dhan App, Web & Trade from Charts on TradingView, only on Dhan.

-Jay

Cofounder, Dhan