With rising global uncertainty regarding wars, Fed rate hikes, and rising Covid-19 cases, one thing that is haunting us is the performance of the stock market and, eventually, our portfolio! No one wants the crash of March 23, 2020, to happen again. And it’s unlikely as well…but shallow dips are inevitable, just like we are witnessing from the past few sessions.

So, it becomes crucial to include those securities in our portfolio that would provide a cushion to the shocks. And this can be done via HEDGING!

What is Hedging?

There goes a saying “Don’t put all your eggs in one basket” for when the basket falls, you would sleep hungry! The same goes for your assets and portfolio.

So what to do is diversify and that too in a manner that when one asset class is going through troughs, another asset class is taking the portfolio to the moon or at least doing break even! (Not a crypto recommendation)

In technical terms,

Hedging is a risk management strategy where losses in one investment class are offset by profits in another by taking an opposite position.

Metals as a hedge - a safe haven to invest?

Metals in the commodities market are emerging as strong hedging assets. That’s because commodity prices generally move in an opposite direction from equity stocks! And here, Gold and silver are leading the queue. Both can hedge the inflation also- meaning returns from gold and silver can override the rising inflation and decreasing purchasing power parity!

While the demand for gold is driven mainly by the consumer segment, silver has found its use in the form of wide industrial applications – ranging from batteries to semi-conductor chips! (Note that EV is the future!) So investing in silver can be a bet on future technological advancements and away towards clean energy as well!

The silver prices moved from INR 40000 on March 31, 2020, to INR 60000 on March 31, 2021, when the stock market crashed due to pandemic!

But why is Gold a hedging asset?

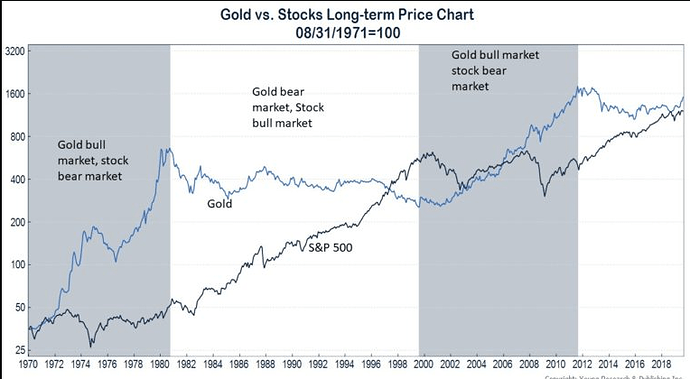

It is because there is an inverse relationship between the Stock Market and Gold prices i.e. when the stock market falls, gold tends to reach new peaks and vice-versa!

The explanation goes that when the economy is in a downtrend and businesses are affected negatively, the returns from their shares fall. This makes the investors (or traders) shift their funds from stocks to the gold market until the market rebounds. This creates a high demand for the yellow metal and eventually raises its prices.

(Remember when demand rises, price rises)

The following graph makes it clear how the movement of Gold Prices was opposite to the Stock market!

Therefore, having little exposure to both gold and silver can optimize your portfolio.

For conventional investors, investing in gold means buying Physical Gold -jewelry, ornaments, bars biscuits, or coins. Once bought, they may give a sense of wealth, but without any dire needs, rarely does anyone sell it to realize the profits. Plus the physical storage costs, safety concerns, making charges for jewelry & ornaments, and doubts about purity outweigh the real returns it brings to the table.

What are the alternate investment avenues for gold?

1. Digital Gold:

- Similar to Physical Gold in quality and value but different in the form it is received-digital form. Once bought online, it is stored in physical form inside the insured vaults of the service provider but stored in digital form with the owner.

- Digital Gold can be bought directly either from the refiners (MMTC PAMP, Augmont Goldtech, and SafeGold,) or through their partnered firms like Paytm, Amazon Pay, etc. Recently, conventional jewelers like Tanishq and Kalyan Jewelers have also entered the league.

- Another differentiating factor is its ticket size- You certainly can’t buy physical gold for Rs1/ 100/1000- but digital gold can be bought for any ticket size- from Re1 to Rs 2 lakh which is the maximum limit to buy gold in a single day!

2. Sovereign Gold Bonds (SGB)-

As the name suggests, these are bonds issued by the sovereign i.e. the government of India through RBI.

Think of it this way- you are purchasing the gold but in the form of bonds. The cost of purchase and price of selling will be at par with ongoing gold prices. With the added benefit of skipping the physical storage cost, comes the guarantee and safety of redemption and capital appreciation. But how?

SGBs leverage the value of gold as they -

-

generate extra income for the investors in the form of interest of 2.50% per annum paid semi-annually

-

give tax exemption on long-term capital gain (on redemption),

-

are tradable on exchanges meaning high liquidity

SGBs are issued periodically in the form of a tranche (portions) The last tranche was open for subscription between February 28 and March 04, 2022. RBI will soon announce the schedule for FY '23. Don’t miss it!

3. Gold ETFs-

Quickly a description of ETF!

ETF stands for Exchange Traded Fund. It is an investment instrument, precisely a mutual fund, which tracks the prices of physical gold. When prices of gold rise, the unit price of ETF (NAV: Net Asset Value) rises and vice-versa.

-

As the name suggests, they are tradeable on exchanges i.e. an investor can buy/ sell a unit of ETF on the exchanges (National Stock Exchange or BSE), just like a share. Since it involves exchanges, it requires a Demat Account for taking the delivery of these units.

-

As of now, there are eleven gold ETF schemes offered by various fund houses and AMCs in India. These ETF schemes are backed by physical gold bought by fund houses and stored in safe, audited, and insured vaults.

-

As per the latest data released by the Association of Mutual Fund, Industry (AMFI) which is the regulatory body, the Gold ETF portfolio has witnessed a rise of 658% increase from 4.2 lakh to 32.1 lakhs between December 2019 and December 2021.

And what about silver?

India has recently got its very first Silver ETF and FoF in the form of ICICI silver ETF and is closely followed by other AMCs (Asset Management Companies) with similar offerings. A quick point of differentiation between ETF and Fund of Funds:

“ETFs are traded on exchanges and need a Demat account (account with stockbrokers like Zerodha, HDFC Securities, Groww, Upstox, etc). Whereas Fund of Fund (FoF) doesn’t need any Demat account, investors can apply via its New Fund Offer (NFO, counterpart of IPO for mutual funds) on the funds’ websites.”

Apart from physical silver and ETFs, direct investment in silver refineries can also be a viable option!

Ideally, Gold and Silver should make up around 8-10% of your portfolio to hedge your wealth!

That is it for now!

Till then, Happy investing!

-Niyati Muley

For more such articles, please do subscribe to my newsletter:

https://3minutefinance.substack.com/

(Disclaimer- The views presented here are by no means a piece of investing advice. Proper research and user discretion before investing are needed.)