I am seeing this Rustam.

Hi @pavz

The integration is there but it seems like its broken, it does not sync the entire duration. Just some old transactions only. I was just checking on the forum here, there seems to be other users facing the similar issue.

Zerodha sych works without issues in Quicko.

Do you know if the alternative, cleartax works without any issues with Dhan?

ClearTax should be working.

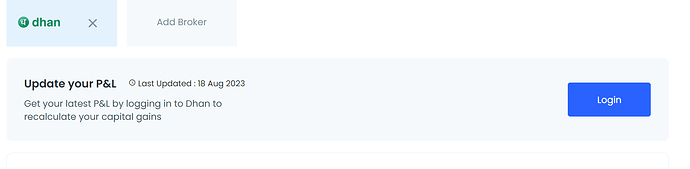

Got the following mail from Dhan when I raised the issue with them regarding ClearTax auto import

Quicko is not working yet. It’s been a while since the issue was reported. @quicko @iamshrimohan any update pls ?

Cleartax I think we need to manually upload the data. @cleartax pls correct me if am wrong.

Please raise a ticket by sending an email to help@quicko.com with necessary details including your registered email id, Dhan client id etc. Thanks.

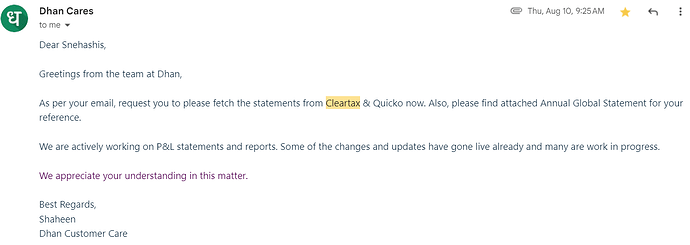

@vishvajit a ticket was raised with @quicko on 21 Jun 2023 and did some follow up on subsequent days as well. But the issue is not fixed yet.

Hey @t7support,

Kindly let us know the ticket number or write to us at help@quicko.com with the registered E-mail address so that we can analyze the issue and provide a resolution at the earliest.

@quicko I was not given a ticket number after I wrote to you guys. U can see how many mails I have sent.

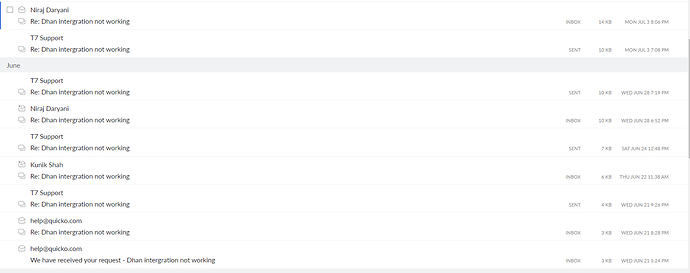

The last mail I got I am sharing here. I have again forwarded the mail to help@quicko.com

If you guys are advertising a feature it’s incumbent upon you to ensure that it works. Even after a support request is raised, several follow-ups have been made and couple of months have elapsed since then and issue is not fixed what message do you convey to the user ?

@quicko this is very bad on your part. Just your advertisements are pro “File your ITR within 5 minutes”. Atleast trading-related ITR filing should be breeze since everything is already structured in trading filings.

@t7support I think @cleartax is too integrated with Dhan. You may give it a try!

Hi @t7support,

We apologize for the delay in providing a resolution. The issue has now been resolved from our end. We kindly request you to retry and please feel free to reach out to us if the issue persists.

@quicko for IPO allotments (and subsequent sell), I see that the PnL report by Dhan doesn’t have the buy price, or rather the buy price is shown as zero. Hence, the profit comes out to be entire sell amount, which is of course incorrect.

My question is whether Quicko takes this into account while doing taxes and allows us to edit the buy price?

Hi @encore,

On Quicko, we import the data provided to us by the broker and report it in the same manner.

However, after you import your data on Quicko, you can select a particular trade and edit the details to report gains accurately.

We are working towards enabling the functionality to incorporate corporate actions with our broker partners.

Hope this helps!

Hi @t7support ,

We analyzed your issue and found a few data discrepancies, so we have informed to the Dhan team and are coordinating with them to resolve this quickly.

@quicko @Vishvajit ye kabhi kaam bhi karta h?

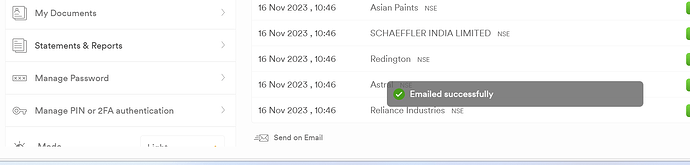

itne dino se tax pnl email karne ka try kar rha hu. likha aa jata hai “emailed successfully” (check screenshot), email aata nhi h.

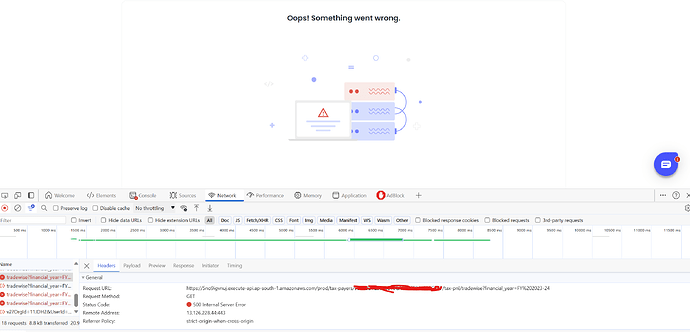

Aur fir quicko pe try kia to wahan “oops something went wrong”. aapki API hi 500 Internal server error de rahi h. (check screenshot)

customer support pe mail kia to 1 mahine se thread latka rakhi h with no response.

15 dec last date hoti h Advance Tax ki aur yahan tax report ka ata pata nahi. hadd hai!

Hey @mark3tn00b,

Kindly provide us with the ticket number so that we can look into the issue and provide a resolution at the earliest.

Here is the ticket number - 60293

Hey @mark3tn00b,

There is some technical issue at DHAN’s end. We have already raised it with DHAN’s team and their team is actively working on the same.

However, we also understand that tomorrow (15th December) is the due date to pay advance tax for the 3rd quarter. Hence, if you are able to visualise the tax P&L on DHAN, we can connect you with one of our tax experts who can help you calculate and pay advance taxes.