This is one of the most popular systematic trading strategy.

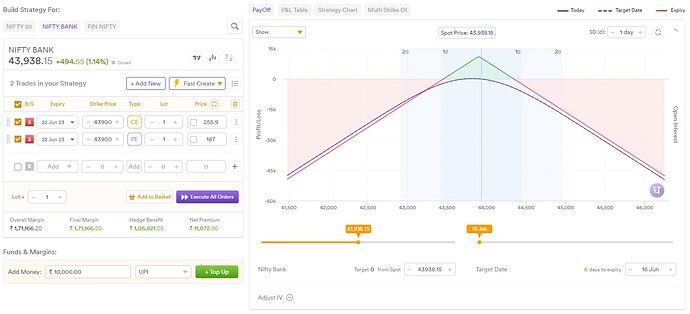

In this strategy, we execute a short straddle trade every day at 9:20 AM by selling an at-the-money (ATM) call option and an ATM put option. The trade is closed between 3:00 PM to 3:15 PM. As the market opens, there is typically high volatility due to uncertainty among traders about market direction, leading to inflated premiums. We take advantage of this by selling the straddle and benefiting from theta decay.

However, it’s important to be aware that significant one-sided market moves can result in losses. To manage this risk, we set a stop loss on both the call and put options. The specific stop loss percentage can be chosen by the trader and typically ranges from 20% to 30%.

On days when the market exhibits strong trends, we may choose to close one leg of the trade early while keeping the other leg open to continue accumulating profits. Conversely, on days when the market remains range-bound, both the call and put options can generate profits due to theta decay, which gradually reduces the value of the options over time.

Traders may customize this strategy based on their experience and knowledge. They can make adjustments to the entry time, exit time, stop loss value, and even the logic for handling one-sided moves. If you have tried this strategy, do share your experience with us.