@PravinJ

Also add “margin with existing positions” in basket.

Thanks for the suggestions. We have noted your feedback and we will try to incorporate it in our roadmaps ahead.

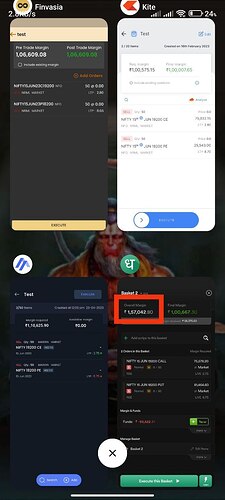

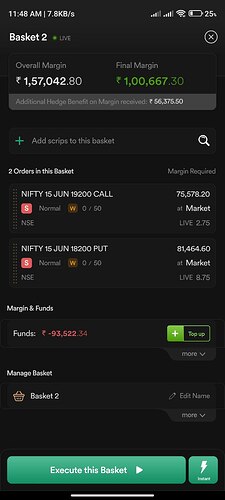

@Naman as you mentioned RMS optimisation by this month. the march ending in 1 day. 1100521239 i traded for a month and paid good brokerage out of profit. If margin issue not being adressed(no broker except Dhan ask for overal margin rather final margin is required for basket orders) then I am switching back my all family accounts to zerodha and IIFL. further there is issue with your api and manual orders during expiry volatality and customer care is not accepting even after screenshot provided. You cant improve anything untill you accept the glitches.

zerodha required margin is 93k while your required margin is 123k which is 30% higher. margin is basic product for any broker and you legging behind in entire industry. other features you are adding is useless until this is corrected.

I also use another broker because “margin with existing positions” not available till now… But I really love the developing speed of DHAN, hope one day it could bit all the competition in this Sector.

Best of luck

Team DHAN.

i agree with u on manual orders during expiry volatality & overall margin requirement , rather than the final margin required to execute even after Buy order kept first @Rajuvala

Hello @PravinJ it has been 2.5 MONTHS since your comment on rectification of margin requirement of 2.55 lacs for a BN SS.

The issue has NOT been fixed TILL NOW !

I have been constantly trading with Dhan patiently for this long hoping it would be fixed. But I have almost lost my patience.

How much more time will it take to fix this ??

I’ll be forced to shift to another broker, if it continues this way.

Hello @PravinJ

Your response is still awaited on BN SS high margin issue fixup.

How much more we have the wait ?

@Divyesh @Poornima @PravinJ

But that’s not the solution na…

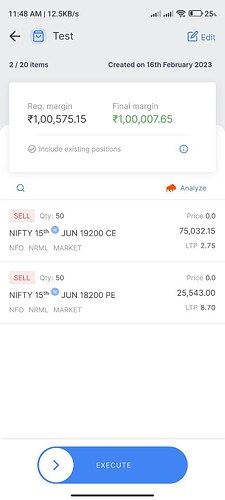

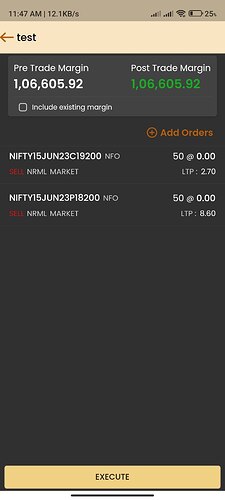

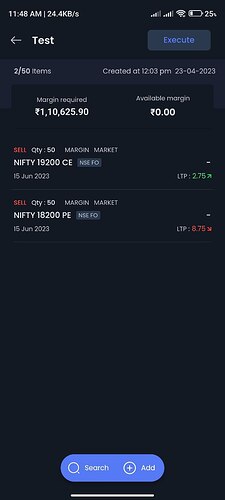

what’s the use of final Margin if we can’t able to execute our trades just because of your so called “overall Margin” u Take care of overall margin in the back office, let us trade with final margin requirements just like other brokers.

Dhan’s team is very understanding & helpful team and always care for their beloved traders & customers, then why u people not able to understand the Main problem of ours in this issue. if we are executing two trades & that too Buy first then sell , so obviously u guyz should let us execute the basket with final Margin. JUST DUE to OVERALL Margin we can’t able to execute the deserving trades even if we have THE FINAL MARGIN. plz understand the pain behind this DHAN Management & team… ![]()

![]()

Hello @Divyesh

The problem is, to execute BN SS I need around 2.7 lacs of fund in Dhan. Where as in other brokers like Zerodha only 1.6 lacs is needed to execute this trade.

Please don’t mention the margin that is getting released after the SS is executed. That is not at all useful.

There are SOO MANY people like me who trade only in short strangles/straddles (like 9:20 SS), they just enter the SS position ONCE at the start of market and close it during the day.

With Dhan it is a nightmare scenario for them. As, you ask to keep almost 1.7 times the margin that any other broker asks.

With this huge margin, this strategy becomes useless as it drastically reduces profit margin.

There as large no. of people who have stopped trading with Dhan due to this single reason. I will also be doing the same thing !!

I can see people have been complaining about this issue since last year, but you guys haven’t fixed this TILL NOW.

And I think you people will not be doing so in future as well. I am extremely disappointed and frustrated.

@PravinJ Our beloved Pravin sir… Can we have a solution on this thing… you may win many hearts of Dhan users & who just left because of this thing! plz understand the real concern and depth of the issue… we are already offering the required Final Margin ! you don’t need to compromise on that… plz re-think on this issue & we may have a good conclusion ! ![]()

![]()

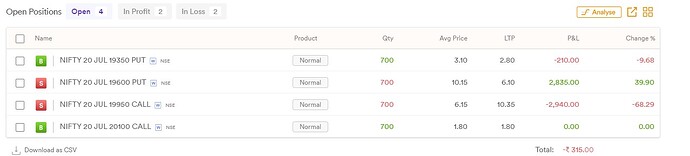

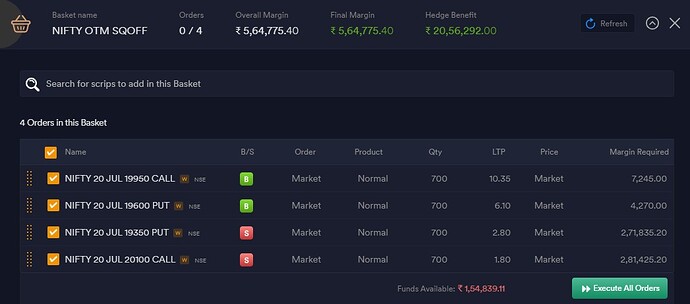

I have 4 open positions created through a basket , now I created another basket with reverse positions , was expecting the margin to be shown almost negligible , still it calculates something substantial . which does not give enough confidence if the basket can be executed.

Does not it consider open positions while calculating the margins , if yes then the calculator not useful.

@PravinJ @Naman @Divyesh

Hello @jacharjya1978

Yes, we do not consider open positions while displaying basket margin requirement. However, if you are squaring off positions, then it will require negligible margin (provided you close short positions first).

We have this in our roadmap to include existing positions as well while calculating margin.

Which broker did you move to bro? Looking for a new broker as well.

Dhan is demanding an almost 20% higher margin than Zerodha for a simple credit spread and it is still more after you deduct the net credit.

Hello @SRT

Welcome to Dhan community!

The margin calculated on Dhan is as per the exchange provided SPAN + exposure. There are some brokers in the industry who deduct the premium received from the final margin.

At Dhan, we have decided to not take this practice as this might be misleading for the trader. While executing the trade, trader needs to have the amount shown as Overall Margin in their account to execute and later only Final margin minus Premium received is blocked.

If you still think this issue persists, can you please highlight some of these cases where you found the margin difference. We can relook our calculations if required.

Also @SRT you won’t get upfront hedge margin benefit when trading with Zerodha. They don’t allow you to buy OTM options first (hedge leg) with out having a short option position. This means you will have to have enough funds to provide full margin on your naked short position first. Only after the order is placed you get the hedge margin benefit.

Hey Hardik,

I just created a basket on both Zerodha and Dhan, it is a simple credit spread.

(Edit: unable to add images because the forum system is not allowing me to.)

The net credit in this position is roughly 19,500, even if you add back it to Zerodha’s required margin, Dhan’s margin requirement is still close to 20% higher. Please note the order type in the Zerodha screenshot is MIS but that doesn’t change the margin much, infact when I changed it to NRML, it reduced a little bit.

Am I missing something? Also, do margin requirements consider active positions? I once had a few lots of long calls but when I added the same number of call lots for a sell order on the order screen, it showed me the full naked margin, why is the full naked margin required if the hedging contracts are already in active positions?