Hello Traders,

We aim to offer the best product experience to our users, working on feedback and improvising from time to time. Meanwhile, over last year, we have scaled our systems and improved core trading architecture, with 50% orders now executed in under 50 ms and 85% orders under 100 ms, even with > 20x volume increase in the past year.

This core trading infrastructure is what powers our APIs, which is used by 75+ platforms (including the likes of TradingView, smallcase, Stratzy, OI Pulse, and likes) and thousands of individual algo traders who are building their trading systems with DhanHQ Trading APIs.

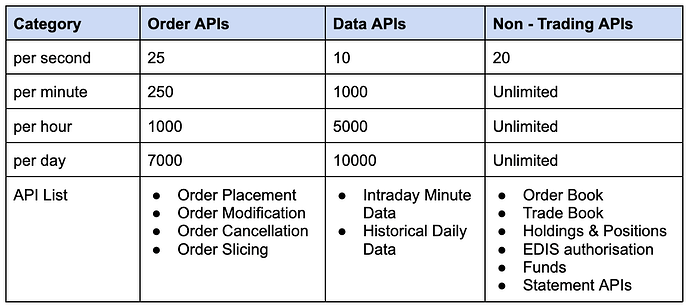

For DhanHQ APIs, we have aimed to provide most liberal rate limits while attaining system uptime and low latency. This is why we have allowed a maximum order per second rate of 25 orders for our users, to ensure super traders can trade without worrying about rate limits.

When we introduced APIs, we introduced minute, hourly and daily rate limits to ensure that the APIs are not being exploited by polling in loops and ensure system stability. However, as we enhanced our infrastructure and built capability to handle multiple thousands of requests concurrently, we are now removing rate limits. There will be no rate limits on Non-Trading APIs for minute, hourly or daily levels.

The updated rate limits are as follows:

This is to make it more convenient for algo traders and coders to bank on our APIs, without worrying about rate limits and keeping that in check.

As we ramp up to launch our Market Feed APIs, we are ensuring our systems offer lowest latency possible on all our APIs. We constantly reiterate our products to adapt to requirements, and all your feedback helps us in building that.

Hardik

Product