Hello Traders and Investors,

We continue to build Dhan and improve our Customer Experience based on a lot of feedback that we get from our users. We understand that for traders - improved Margins and availability of Cash in Hand are two of the most important aspects to ensure they are capital efficient - while they are trading and also when they are not trading.

In order to enhance our customer experience, we’ve further updated our Risk Policy regarding blocking of margin and making additional cash available for withdrawal from Dhan. As you’re aware, for any position taken in the securities market, a minimum of 50% of the margin funds must be fulfilled from Cash (Ledger Balance) or Cash Equivalent Securities (such as Liquid ETFs, G-Sec, SGB, etc.), with a maximum of 50% from Non-Cash Securities (such as certain ETFs, Equity Shares, etc.).

Here’s an overview:

Cash component of Margin: Cash (Ledger Balance) + Valuation of Cash Equivalent Securities

Non-Cash component of Margin: Valuation of Non-Cash Equivalent Securities

Initially while blocking the margin, we used to block the Cash component (without prioritising Valuation of Cash Equivalent Securities over Ledger Balance). Now, when blocking the cash margin, we prioritise blocking the Cash Equivalent Securities over your Ledger balance, allowing you the flexibility to withdraw the clear ledger balance via payout.

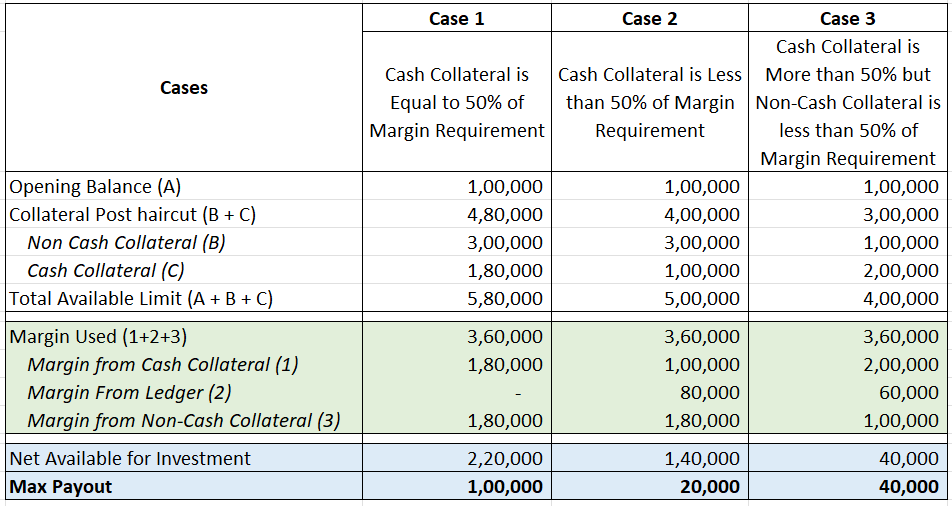

Example Cases:

Assume that you have Rs. 1,00,000 as clear ledger balance on a given day and you take a position which has a margin requirement of Rs. 3,60,000. Now as per the exchange mechanism at least Rs. 1,80,000 must be from Cash and Cash Equivalent securities while at max Rs. 1,80,000 can be from Non-Cash Equivalent Securities. Below are the cases highlighted with different values of collateral values that affect the payout.

Note that same day pay-in of funds and CNC Sell Benefit will be considered as Non-Cash collateral for Trading limit for T day and shall NOT be considered for payout as in both these cases we as a Stock Broker are yet to receive funds in our accounts.

We hope these changes in our policy to block margins and make additional cash available for withdrawals will benefit you as a trader and in managing your capital more effectively and efficiently.

While on the topic of managing money and margins, don’t miss on these incredible features that Dhan provides to you as a trader:

- Margin Benefits & Pledge Experience on Dhan: Full post: Margin Benefits & Pledge Shares Experience for Trading on Dhan

- Commodity Trading Experience on Dhan: Commodity Trading Experience on Dhan - Simple, Smooth, & Seamless!

- Discovery of Trader Friendly Margin scrips on Dhan: Now Live: An All New & Improved Pledge Experience on Dhan

We as usual are always open to your feedback and suggestions.

Thank you

Kuldeep Mathur