Hi team,

Have bought some GOI bonds in secondary Market.

When is the interest paid , is it paid in fixed month 2 times yearly/ or 6 months from date of purchase .

Hi team,

Have bought some GOI bonds in secondary Market.

When is the interest paid , is it paid in fixed month 2 times yearly/ or 6 months from date of purchase .

Hi @pavz The payment of interest for GOI bonds is as per their date of issuance and it is paid semi-annually. The coupon payment (interest payment) does not depend on when you purchase the bond from the secondary market (Exchange or Offline Transfer)

For example: 7.40% GS 2062 (IN0020220094) was issued on 19-Sep-2022 and would mature on 19-Sep-2062. This bond will pay interest on 19th Sept and 19th March every year until maturity.

hI @iamshrimohan Can you please let know when is the semi annual payout for these 2 bonds.

I was expecting it today ( JuNE 1st) but does not seem to be the case.

GOI LOAN 7.10% 2029

GOI LOAN 6.18% 2024

Hi @pavz please find the below schedule for the interest date payments of the G-Secs. Note that these dates are tentative (derived from the redemption date and holidays are not factored).

| SYMBOL | ISIN | Coupon Rate | Interest 1 | Interest 2 | Redemption Date |

|---|---|---|---|---|---|

| 448GS2023 | IN0020200211 | 4.48 | 02-May | 02-November | 02-11-2023 |

| 456GS2023 | IN0020210210 | 4.56 | 29-May | 29-November | 29-11-2023 |

| 515GS2025 | IN0020200278 | 5.15 | 09-May | 09-November | 09-11-2025 |

| 522GS2025 | IN0020200112 | 5.22 | 15-December | 15-June | 15-06-2025 |

| 563GS2026 | IN0020210012 | 5.63 | 12-October | 12-April | 12-04-2026 |

| 574GS2026 | IN0020210186 | 5.74 | 15-May | 15-November | 15-11-2026 |

| 577GS2030 | IN0020200153 | 5.77 | 03-February | 03-August | 03-08-2030 |

| 579GS2030 | IN0020200070 | 5.79 | 11-November | 11-May | 11-05-2030 |

| 585GS2030 | IN0020200294 | 5.85 | 01-June | 01-December | 01-12-2030 |

| 610GS2031 | IN0020210095 | 6.1 | 12-January | 12-July | 12-07-2031 |

| 618GS2024 | IN0020190396 | 6.18 | 04-May | 04-November | 04-11-2024 |

| 619GS2034 | IN0020200096 | 6.19 | 16-March | 16-September | 16-09-2034 |

| 622GS2035 | IN0020200245 | 6.22 | 16-September | 16-March | 16-03-2035 |

| 645GS2029 | IN0020190362 | 6.45 | 07-April | 07-October | 07-10-2029 |

| 654GS2032 | IN0020210244 | 6.54 | 17-July | 17-January | 17-01-2032 |

| 664GS2035 | IN0020210020 | 6.64 | 16-December | 16-June | 16-06-2035 |

| 667GS2035 | IN0020210152 | 6.67 | 15-June | 15-December | 15-12-2035 |

| 667GS2050 | IN0020200252 | 6.67 | 17-June | 17-December | 17-12-2050 |

| 669GS2024 | IN0020220052 | 6.69 | 27-December | 27-June | 27-06-2024 |

| 676GS2061 | IN0020200401 | 6.76 | 22-August | 22-February | 22-02-2061 |

| 689GS2025 | IN0020220128 | 6.89 | 16-July | 16-January | 16-01-2025 |

| 68GS2060 | IN0020200187 | 6.8 | 15-June | 15-December | 15-12-2060 |

| 695GS2061 | IN0020210202 | 6.95 | 16-June | 16-December | 16-12-2061 |

| 699GS2026 | IN0020230028 | 6.99 | 17-October | 17-April | 17-04-2026 |

| 699GS2051 | IN0020210194 | 6.99 | 15-June | 15-December | 15-12-2051 |

| 706GS2028 | IN0020230010 | 7.06 | 10-October | 10-April | 10-04-2028 |

| 710GR2028 | IN0020220136 | 7.1 | 27-July | 27-January | 27-01-2028 |

| 710GS2029 | IN0020220011 | 7.1 | 18-October | 18-April | 18-04-2029 |

| 716GS2050 | IN0020200054 | 7.16 | 20-March | 20-September | 20-09-2050 |

| 717GS2030 | IN0020230036 | 7.17 | 17-October | 17-April | 17-04-2030 |

| 719GS2060 | IN0020200039 | 7.19 | 15-March | 15-September | 15-09-2060 |

| 726GS2029 | IN0020180454 | 7.26 | 14-July | 14-January | 14-01-2029 |

| 726GS2032 | IN0020220060 | 7.26 | 22-February | 22-August | 22-08-2032 |

| 726GS2033 | IN0020220151 | 7.26 | 06-August | 06-February | 06-02-2033 |

| 727GS2026 | IN0020190016 | 7.27 | 08-October | 08-April | 08-04-2026 |

| 729GR2033 | IN0020220144 | 7.29 | 27-July | 27-January | 27-01-2033 |

| 732GS2024 | IN0020180488 | 7.32 | 28-July | 28-January | 28-01-2024 |

| 736GS2052 | IN0020220086 | 7.36 | 12-March | 12-September | 12-09-2052 |

| 738GS2027 | IN0020220037 | 7.38 | 20-December | 20-June | 20-06-2027 |

| 741GS2036 | IN0020220102 | 7.41 | 19-June | 19-December | 19-12-2036 |

| 74GS2062 | IN0020220094 | 7.4 | 19-March | 19-September | 19-09-2062 |

| 754GS2036 | IN0020220029 | 7.54 | 23-November | 23-May | 23-05-2036 |

| 757GS2033 | IN0020190065 | 7.57 | 17-December | 17-June | 17-06-2033 |

| 762GS2039 | IN0020190024 | 7.62 | 15-March | 15-September | 15-09-2039 |

| 763GS2059 | IN0020190057 | 7.63 | 17-December | 17-June | 17-06-2059 |

| 769GS2043 | IN0020190040 | 7.69 | 17-December | 17-June | 17-06-2043 |

| 772GS2049 | IN0020190032 | 7.72 | 15-December | 15-June | 15-06-2049 |

Thnx a lot , this helps !

Hi @iamshrimohan have a doubt.

Suppose i have bought some goi in Jan , and the intrest pay out is in oct. If I exit in secondary market in Sep itself, will the interest from Jan to September will be calculated and credited in OCT ?

Interest is paid only to holder of the bond on record date (interest date).

So when you exit in secondary market you must factor in the interest in your sell price itself.

Btw if you bought the bond in January, you should receive atleast one interest payment by July end. (six month interest cycle)

@pavz Yes as what @amish said, just adding a note on the same as well.

In case of bonds, the interest (accumulated) is added in the bond price itself. For example, Jan 1 bond will have zero interest component where is June 25 bond will have almost 6 month interest component. Hence, the price of the bond increases as the interest payment date nears. The price is Base Price + Accumulated Interest and this price is called “Dirty Price”.

I think what @iamshrimohan said about dirty price applies if you buy GOI bond from bond market. Like RBI NDS.

But I think @pavz means he bought bonds in DEMAT form from NSE/BSE just like buying shares, in which case there is no concept of dirty price. i.e. interest is not added to your purchase price or sell price. The quoted price is actual price you pay or get.

@amish The dirty price is applies in Secondary Market only like NSE/BSE. In NDS-OM (Primary Market for G-Sec), the bonds are sold at face value.

Ok @iamshrimohan, so you mean to say the prices of G-secs that are currently on sell on NSE here: (On top - under category dropdown - select G-sec)

https://www.nseindia.com/market-data/bonds-traded-in-capital-market

There lets pick G-sec with SYMBOL - 738GS2027. You can see its current trading details here:

https://www.nseindia.com/get-quotes/bonds?symbol=738GS2027&series=GS&maturityDate=-

Now the LTP of that G-sec is 102.3.

So if I place buy order for 738GS2027 for 102.3, then I will be paying 102.3 plus accrued interest till today?

I dont think so. I think I will be paying 102.3 only, which is price quoted by the seller. And there is no concept of dirty price in this case.

Btw NDS-OM is not primary market. NDS OM is secondary market where you buy as well as sell bonds. I use it regularly via RBI retail platform. RBI retail direct is primary platform, where you can not sell but you can buy at final “Auction” value and not face value. (unless its a fresh issue)

No I mean to say that the accrued interest will already be added in the ask price by the seller.

| Bond | 738GS2027 | |

|---|---|---|

| Face Value (FV) | 100 | |

| Coupon Rate | 7.38% | |

| Interet Annual | 7.38 | |

| Interet Half Yearly | 3.69 | |

| Date | 13-09-2023 | |

| Last Interest Payment Date | 20-06-2023 | |

| Days after LIPD | 85 | |

| Accured Interest (AI) | 1.7425 | |

| PV of the Bond [FV+AI] | 101.7425 | (Dirty Price) |

| Current ASK | 102.25 | |

| Premium of ASK over PV | 0.5075 |

Yes right about NDS-OM. I was actually referring to a fresh issue.

Yes so thats what I mean, price (ASK price) is determined by the seller on NSE. He may or may not include Accrued interest in his ASK price. It is at seller’s discretion.

But in case of NDS OM, where whatever price seller decides (ASK price) then NDS OM automatically adds accrued interest to that price. So buyer pays for ASK price plus accrued interest, over and above ASK price.

@amish Ohh that is something new for me, never dealt in NDS-OM practically. Thanks for highlighting. I’ll study over this.

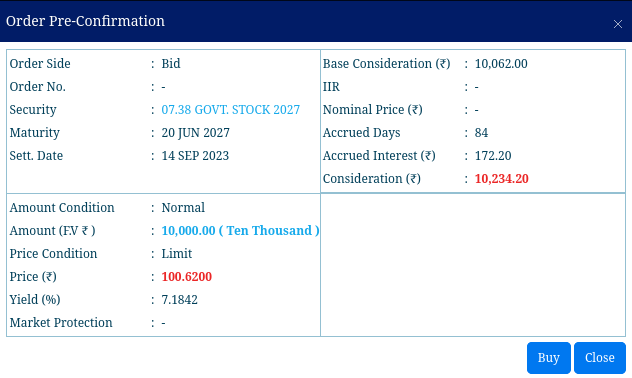

Just for you information.

Here is screenshot of Buy order on NDS OM.

I am trying to buy 100 bonds of Face value 100Rs each.

Ask price by seller is 100.62Rs per bond. So total is 10062Rs for 100 bonds.

But if you see table on right hand side, NDS OM adds accrued interest of 172.2Rs (total for 100 bonds) too.

So I will have to pay ASK price plus accrued interest. Total to pay 10234.20Rs.

can we buy the bond from this NDS OM and send to our dhan demat?

Reverse is possible. i.e. buy from stock market (which gets deposited in DEMAT account) and convert to RDG Account - which you can then sell on NDS OM.

But I am not aware of transferring from RDG account to any DEMAT account.