Today we are announcing a new feature, an update to existing but undoubtedly one of the most requested features of intraday traders on Dhan, both on web & app. We wanted to get this right, as we know this is an important one - so our teams have patiently put in efforts to build this across all platforms, and as always delivered it as an exceptional product experience to users on Dhan.

We are introducing to you, Basket Orders - Now you can place multiple orders at the same time, including Options, Futures, and Equity for intraday traders.

How does this work on Dhan, go to the Orders section on our web or app, you will already see Basket orders has been enabled for you (if you don’t see it on the app, please update to the latest app version on iOS or Android).

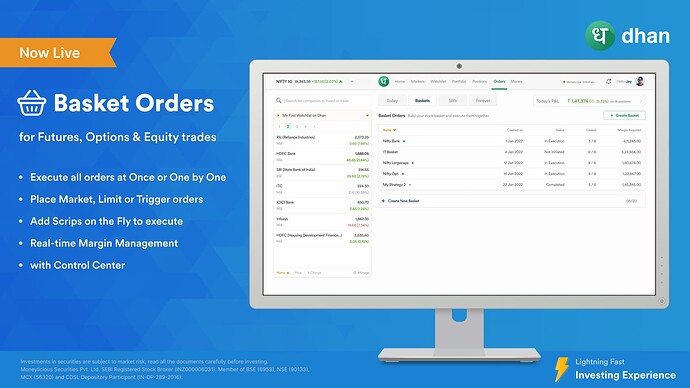

Web Version :

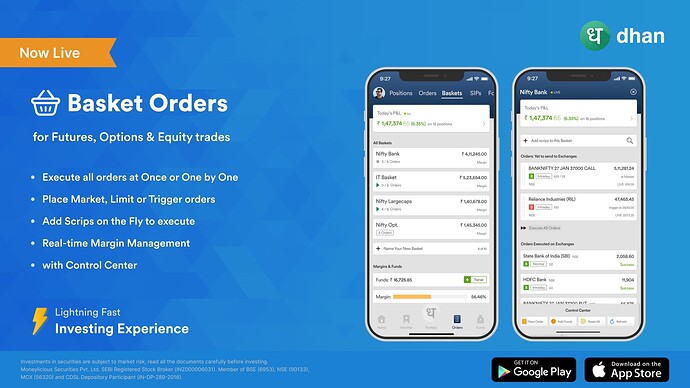

App Verison :

Basket Orders in Dhan will work in the same way, except here you can create a basket of your preferred instruments like Stocks, ETFs, Futures and Options and execute it together at once or one by one or the way you would want them to execute.

Creating your Baskets

As easy as everything is on Dhan, creating baskets on Dhan is also simple.

Just go and create one on the app or website. Once done, you now have a choice of adding any scrip to the basket by searching for it and then selecting the order type and then you are done.

Once added, you can immediately see the margin required for individual orders as well as for the overall basket.

Dual Mode in Basket - Normal & Execution Mode

We know many traders create multiple strategies and like to choose one or more to execute depending on the market. To make that simpler, every basket that you create on Dhan exists in two modes - Normal (one that you have not executed) and Execution (one that you are executing right now).

Adjusted Margin Required for pool of scrips

Users can have a view of the Margin Required for the pool of scrips in a basket with benefits adjusted, if any. The margin benefit is available in options trading when there is both Buy & Sell order in the basket and Buy order is executed at exchange before the Sell order.

There is a tab for Funds Required as well, which is margin required without any benefit adjustment. This is simply the sum of margin required of all the orders individually. It is shown here for the case when there is margin benefit available and Buy order for option does not execute at exchange, so it is indicative that users should have this much amount available in the trading account for other orders to get successfully executed.

It’s all about Margins

Baskets are all about margins. On the full section of Basket you will see all your baskets created with the respective margin required, and yes - in real time. You can also see the margin utilisation of all your positions right there on the main Basket section, or individually inside the basket view as well.

There is more control in your hands

You have the option to reset your baskets, drag and drop to change the sequence of orders, and from the basket as well select certain orders you would like to execute. You will also be able to edit the orders as per your preference. This will be especially helpful to the Options traders.

Execute the way you want, always your way

For every basket that you create, you will also see the option below to execute it, either all at once or starting with the first and then your choice to execute all or one by one orders.

Control Center in Execution Mode

Any strategy that you have in execution mode (where you have executed any order) and markets are on, you will be able to view the Control Center for the same. This allows you to add a New Order to the Basket, Add Funds to ensure you have sufficient margin for the trading day, and an option to Reset All the orders in Basket or simply Refresh the Basket.

Edit Orders

Users can select the type of order they would like to place be it be Market, Limit or Trigger. For each order, users will have the option of placing orders as per their preference.

Duplicate Orders in Basket

Using the duplicate feature, users can easily duplicate their orders in the basket. This will be useful when per order maximum limits are set for trading stocks and F&O.

Executing large orders, multiple orders needs to be placed and duplicate features will make your task easier.

Deleting the Order

If any of your order gets rejected, or you wish to delete any existing order from the basket, you can easily do it by using delete.

We are sure that basket orders are going to be of huge help to the traders. As mentioned earlier, Basket Order was a highly requested feature and we delivered on it. Basket Orders will be available on mobile app, and web.dhan.co.

Let us know your thoughts and stay tuned here, as we are coming up with many features.

P.S: Basket Order will be releasing on iOS soon. We will update once it is live.

Regards,

Naman

Product - Dhan