We launched Dhan to help Indians trade and invest better. While we continue to be in early access with Dhan and work on the feedback we receive from our early users, we are happy to see a healthy split of both investors & traders, a good 50:50 - which basically means we receive suggestions from both and we build for them.

One common request we have received from options traders on our platform was to help them get a deeper understanding of the markets to make trading decisions.

For Options Traders, only seeing the charts, ladder or price action is not sufficient to place orders. They need to have a holistic view of the markets, see where other people are standing and anticipate the direction before placing a trade. We have added details about OI Analysis, Volumes, PCRs and also a Simple Option Chain for them, we have users asking for more - and with that we are extremely happy to announce Advanced Option Chain.

Introducing - Advanced Option Chain on App & Web

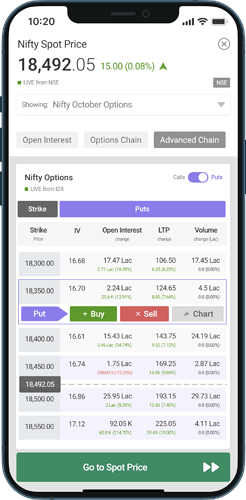

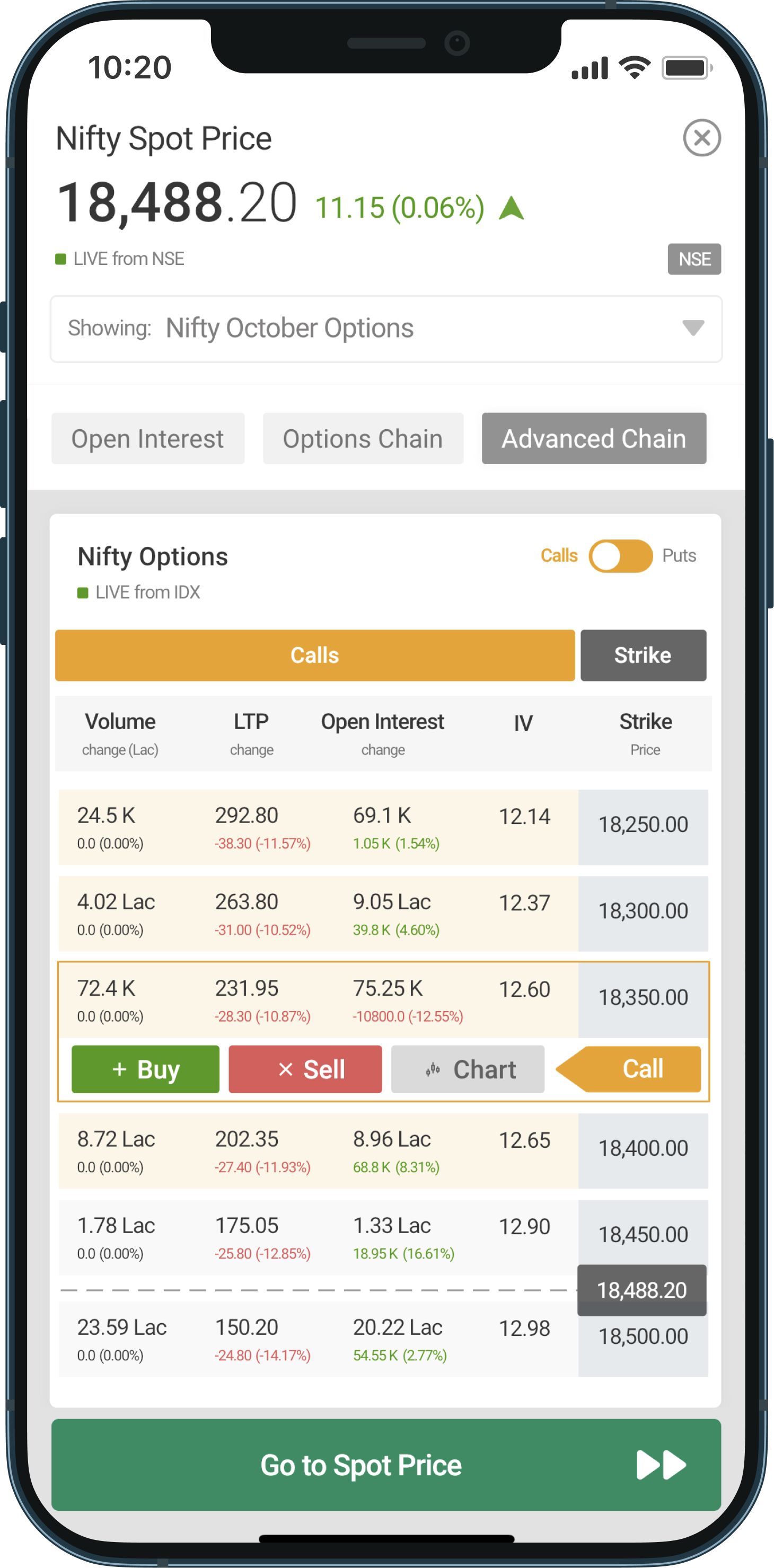

.Advanced Option Chain is a list of all available option contracts for a given security. It lists down all Calls & Puts with their strike price, premiums, volume, open interest & implied volatility. It gives you a quick picture of in-the-money and out-of-the money options.

We have also included visual cues - while the strikes shaded in yellow and purple are the ITM options, on the call and put side respectively. The un-shaded strikes are the OTM options. You can directly place orders, open charts and see market depth, by hovering over to strike price. Additionally, you do not need to refresh every time to update the variables, it updates in real time.

An option chain trading strategy can be formulated by seeing accumulations in OI (Open Interest) and volumes in various option strikes. The increase in OI at call side signals the building up of resistance and vice versa at put side for support. Advanced Option Chain can be used as an early warning setup for breakouts or trends in the scrip. It is because institutions are active in options and they account for high volumes of daily trading, particularly from the sell side. The sudden change in OI of a particular strike is indicative of some interesting action in the scrip.

Hedging strategies like straddle, strangle or condor can be visualised with all the variables on one screen and executed here by placing individual legs at a time by hovering over strikes.

And soon, we will introduce sorting by expiry as well.

Advanced Option Chain is now available on all channels of Dhan - Android, iOS and Web. While this feature of Advanced Option Chain is the first version of it, as always when we launch we will continue to make it better with feedback from you.

Keep us posted, and keep sharing what else you would like to see on Dhan.