Hello Traders,

We understand that Traders want to take positional trades with as little margin as possible.

We are all aware that there is no leverage available on Equity Segment, Cash or Delivery. In order to buy a Stock in cash (delivery), one has to pay the full margin that is required. However, leverage is available for Equity-Intraday on 1250+ stocks at Dhan. One needs to pay only 20% (this may vary) of the margin requirement. The flip side is that stocks bought for Intraday will be squared off at the end of the trading session. This becomes a major problem for Equity Swing Traders or Positional Traders who want to leverage to hold on to their trades in the short term.

For that reason, in November 2022, we launched Margin Trading Facility (MTF) and are glad to see the overwhelming response. In MTF, one need not pay the full margin (as required in delivery) and can hold for days. Here is a detailed post on MTF and its features and offerings. We have continuously improved the experience around MTF. This time, we have introduced Forever Orders to MTF for an improved experience.

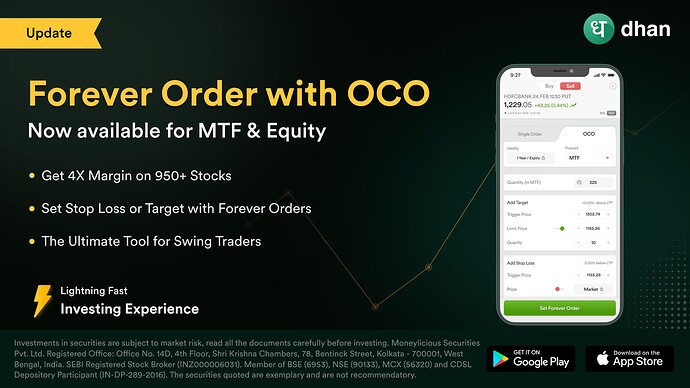

Forever Orders are now available with MTF

MTF and Forever Order complement each other and complete the Swing Trading experience. Now you can take a trade in MTF and set a Stop Loss or Target with Forever Order. This will ensure that your trade exits at your desired price, without you having to track it daily or every now & then.

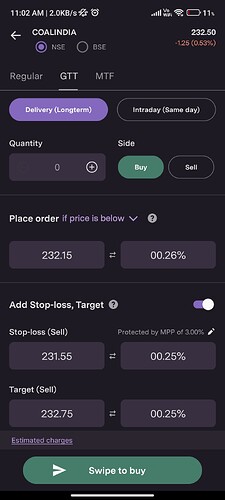

To create a Forever Order for MTF, simply select the product type “MTF” from the drop-down menu. This option to select the product type is newly added. It is enabled for both types of Forever Order: Single Order and OCO Order.

We hope that this addition to our product will be valuable to you for your positional or short term trades. As always, we continue to improve and upgrade your trading experience on Dhan.

PS : With this update you will now be able place forever orders with OCO in Equity also.

Happy Trading!

Pranita