Hello Everyone

We are writing and sharing a few posts for some of the new traders who have started trading recently and may not be completely familiar with some of the terminologies and what goes behind the scene when it comes to trading, investing or everything about markets.

We recently shared notes on how charts work and now this one is about your trading account ledger. We hope we are able to simplify some of these for you, and also get your feedback on making some of our processes and products simple, efficient, and easy to use. We want to make your experience with Dhan awesome, and all such interactions help us go in that direction.

Welcome to our ledger narration! Our goal here is to help you understand the entries that are posted in your trading ledger. If you’re wondering why this is important, let us explain.

What is a Trading Ledger?

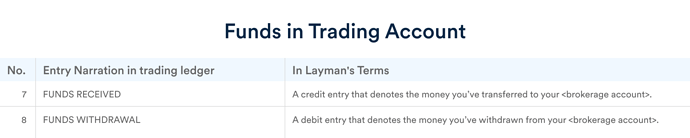

A trading ledger contains details of every transaction - debit or credit from your trading account on Dhan. The most common examples of ledger entries include:

- Funds added to your trading account on Dhan

- Funds withdrawn from your account by you.

- Profit or loss incurred by selling or buying stocks, currencies, & commodities

- Settlement against trades/transactions you do on exchanges

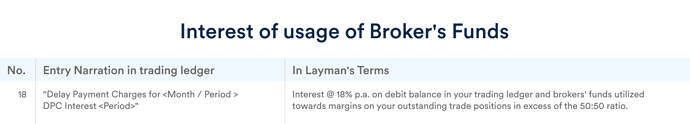

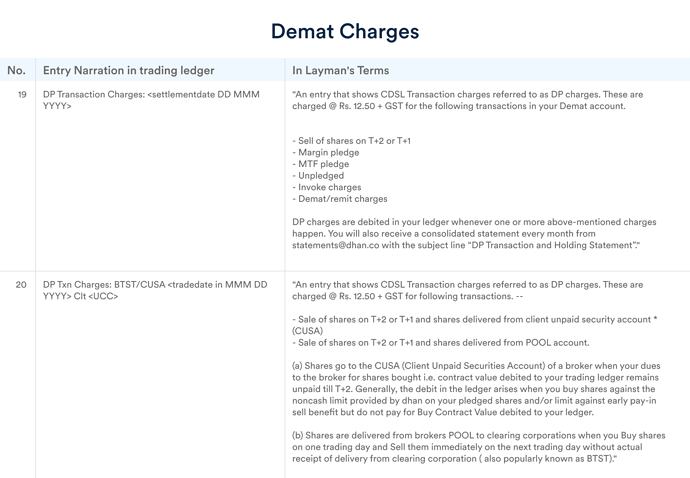

- Other charges for any products or services you use on Dhan

Knowing what each entry in your ledger means can help you identify charges and their implications. The main roadblock that users generally face is of the complexity of some of these narrations, most of which have been industry standards & terms for years now.

Finance and anything to do with it may seem complex and, at times, it is. That said, it’s important to understand the complexity to become a well-rounded trader and investor. This is where a ledger narration can be useful to you.

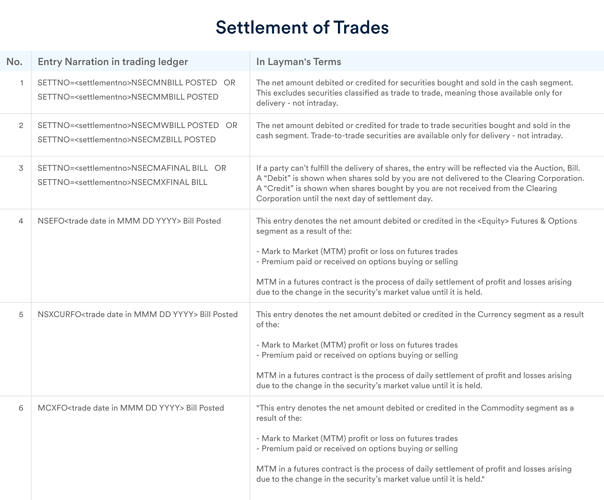

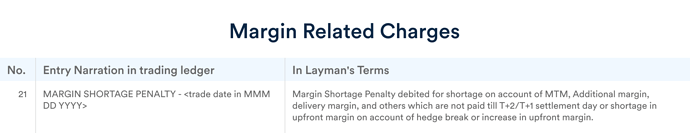

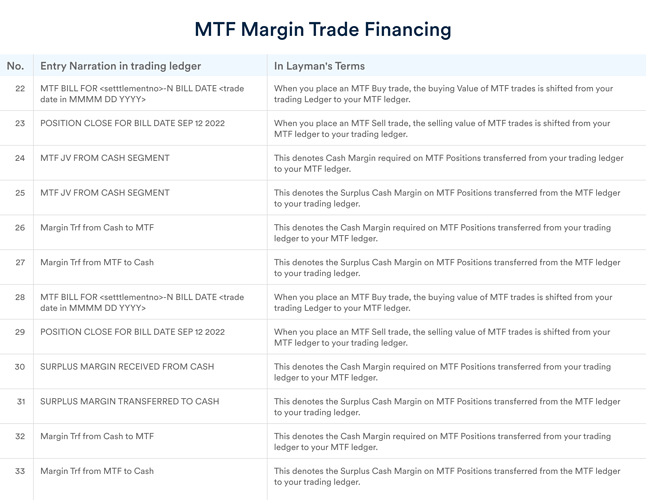

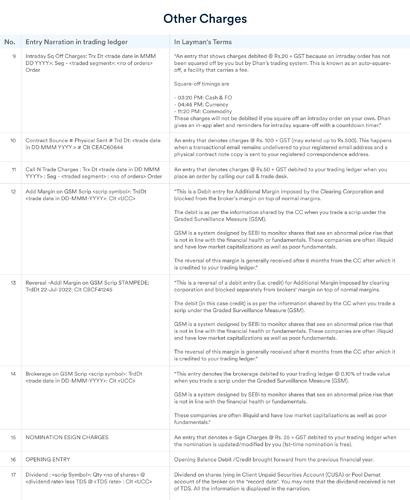

Ledger Narration

A ledger narration is a short explanation of why a debit or credit has taken place in your trading ledger. Here’s a simple explanation of the most important ledger entries

Why are We Posting This?

At Dhan, we want to ensure that you have all the tools necessary in order to trade & invest better, and in addition same, you also know how trading systems work, and as always keep things transparent so you know what exactly you are paying for if you are.

A ledger, albeit not a tool, is a crucial part of the trading & investing process. That’s why we’ve simplified the entries for you. If you have questions or queries, please write to us in the comments below or at feedback@dhan.co.

Thanks for using Dhan

Kiran